The stock market is at all-time highs, inflation is supposedly contained, unemployment reflects what is arguably considered full employment, and yet the Fed is cutting rates. Is the economy healthy or not? Despite massive government stimulus, the risk still exists, and the good news is that we can identify areas of concern. The bad news is that there may be underlying issues that we do not know about yet. Either option is enough to keep an investor up at night.

Positive Indicators

First, the positive. Government statistics continue to point to a growing economy. The US Bureau of Economic Analysis (BEA) revised 2023 GDP growth up to 2.9% from 2.5%. Much of this growth came from consumer spending. This contradicts other measures, including credit card debt, that imply that Americans were nearing (or past) their limits. New figures estimate that savings grew more than expected. This might shield the economy from a bigger downturn if we slow down. Corporate profits were also revised higher as the pricing power that came with inflation proved valuable.

» Bloomberg: US Post-Pandemic Economic Growth Revised Higher in Annual Update

Negative Indicators and Threats

When looking for catastrophic scenarios, it is often best to start with the banks. As leading economists point out, the financial services sector is the “plumbing” of the economy; if it goes sideways, it can take down everything else. 2008 showed the leverage risks in this area as the housing crisis caused a worldwide recession. I see two primary known threats right now. The US Federal Reserve dictates that banks capitalize with government bonds. When rates increased, they were left with massive amounts of unrealized losses. By rule, if they hold them to maturity (HTM), they do not count against their capital requirements. If they need to raise assets, they list them as available for sale (ATS). This scenario brought down SVB, as we covered in our 2023 article How SVB Banked on Low Rates and Lost Big. The other threat is exposure to commercial real estate (CRE). Workers discovered during the pandemic that they liked telecommuting. Zoom meetings, digital document signing, and the ability to do your job with a laptop and phone made this possible. This means that the space required to house employees is shrinking dramatically. The owners of these properties and the banks that underwrite them could be in big trouble.

Florida Atlantic University (FAU) tracks both measures, but the numbers do not look pretty. You can check out your bank’s soundness here. 90% of the ten most indebted banks have all their securities for sale. Four are technically insolvent, with total assets over $13 billion. If Bank of America liquidates its portfolio at today’s market price, it alone would realize a loss of almost $114 billion. This will work out if they can hold all their assets until maturity or rates drop to 2021 levels. If inflation comes back and conditions force them to sell at a loss, we could see valuations drop and future reluctance to hold government bonds for longer maturities.

Commercial Real Estate (CRE) Exposure

Exposure to commercial real estate looks even scarier. Comparing the total equity of a financial institution to the exposure to CRE provides a risk ratio. Above 300% exposure is considered excessive by banking regulators. Sixty-two banks, representing over $1.7 trillion of assets, fall into this category. Eaglebank of Maryland has $7 billion despite only $1.16 billion equity, yielding a 618% CRE to total equity ratio. The Conference Board, using MSCI Real Assets data, estimates that over $1 trillion in loans will be due or need to be refinanced in the next two years. Unlike mortgages, many of these arrangements pay mostly interest with a balloon payment at the end. This potentially hides the true exposure of financial institutions for this sector. Current agreements at low interest rates combined with lease holders on longer-term contracts might delay or spread out this reckoning.

Federal Reserve’s Role

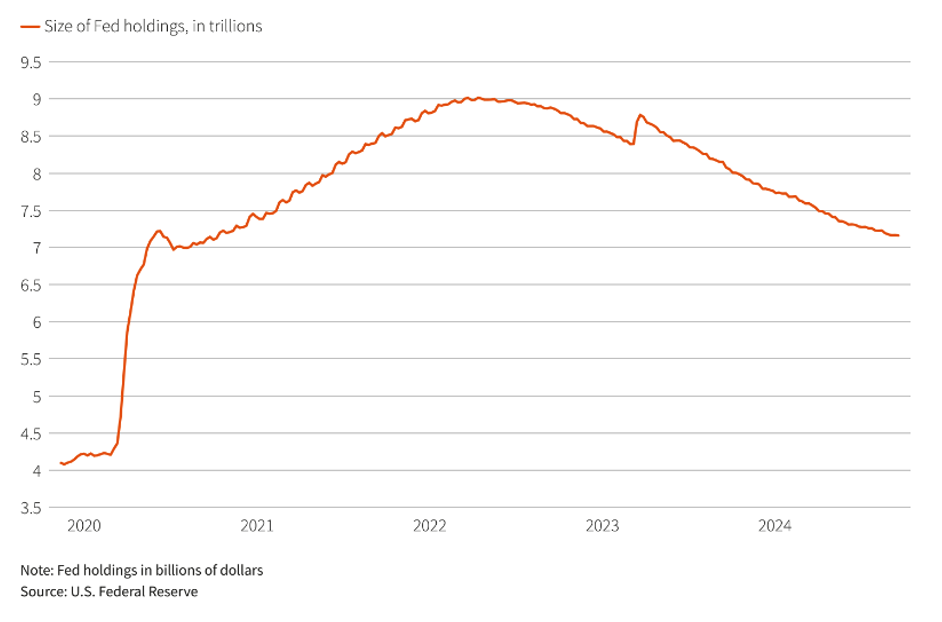

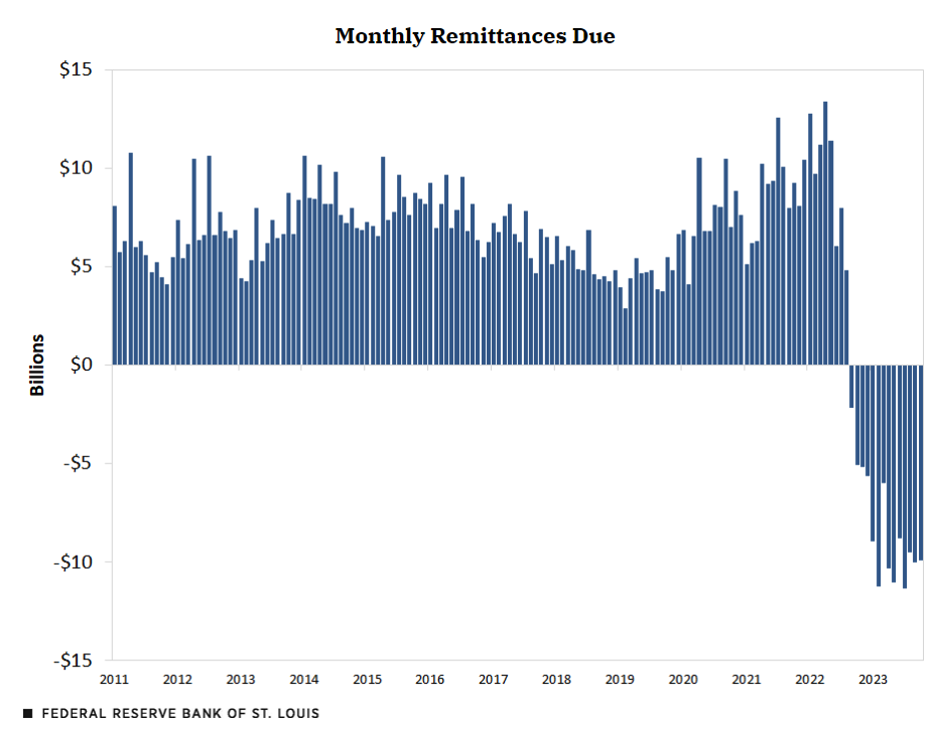

We would be remiss if we did not address the largest player in the plumbing of the banking system. The US Federal Reserve holds over $7 trillion in assets on its balance sheet. This includes massive purchases of US Treasury and Mortgage bonds. If banks, which the government requires to be well-capitalized, struggle with underwater bonds, then imagine their status. By law, the Fed is required to send their gains to the US Treasury. (I will skip pointing out that one arm of the government lends to the other and then shares its profits back to the treasury.) That income does not exceed the costs, so the Fed loses money each month. A chart of this is shown below through early 2024, showing losses of $10 billion a month or more. Like the banks, the Fed will simply hold these assets until maturity or until rates come down. Their only other option is to sell them at a loss. If another crisis occurs, they will need to add even more debt, and the cycle will repeat.

» Reuters: Fed’s Powell says balance sheet drawdown continues amid rate cuts

Hyperinflation Concerns

It is possible that we can keep printing our way out of trouble and kicking our debt issues further down the road. As a friend in Lebanon pointed out yesterday, people in the United States and Europe do not think hyperinflation can happen to us. I am sure many people in his country felt the same way before their inflation rate went to 268% in April 2023. The good news is that the Fed can see some of the issues and mitigate some of the impact. Poor ability to predict post-pandemic effects does not inspire confidence. Government policy that works against their goals might lead to circumstances outside of their control. Let us hope that we worried about nothing during our sleepless nights. I fear this will not be the case.

Photo by Possessed Photography on Unsplash