A common question we received in the futures industry is what happens if an event occurs when the market is closed and we get stuck in a position when it re-opens. It is a good question, particularly with our 24-hour-a-day news cycle in which economic and geo-political events happen at an ever-increasing pace. The implication of such an event is that you achieve either a big gain or a large loss with no ability to exit the position as the price adjusts prior to open and “gaps” to the new level. How should investors view these events and their CTA’s reaction to them?

Understanding Market Gaps and Positioning

A common thread amongst many of these surprise moves is that they are truly unexpected. Heavy positioning on one side of a trade makes conditions ripe for a reset and a rush for the exits by everyone at the same time. This exacerbates the move; the last person out is often the biggest loser. Let us first consider a few examples of events that triggered these surprise moves and their impact on markets.

Case Studies of Market Shocks

Swiss Bank shock (2015)

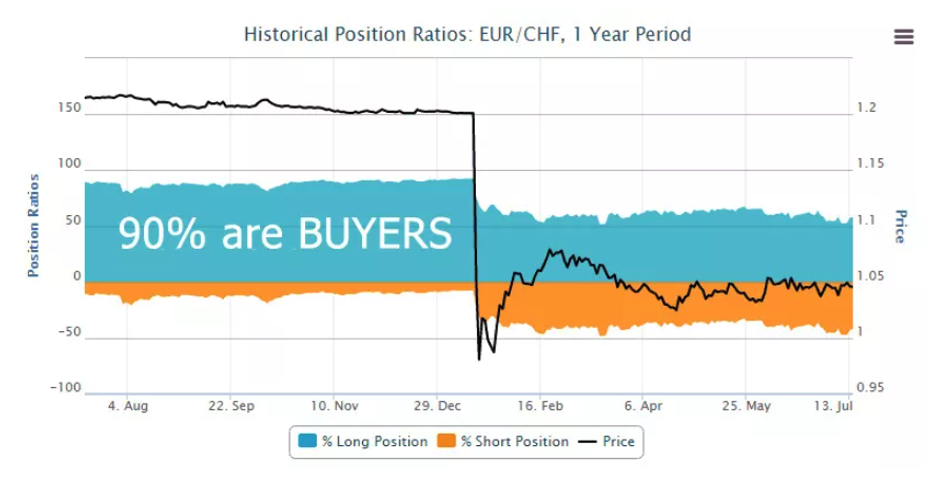

On January 15, 2015, the Swiss Franc gained 30% in a day when their central bank abandoned their pledge to peg their currency to the Euro at a rate of 1.2 Euros per Franc. Weakness in Greece precipitating multiple bailouts put pressure on the European Union-backed medium, making it more difficult to maintain this ratio. This did not stop traders from participating in “an easy trade” because the Franc would be allowed to go above the 1.2 ratio but not below per rules for the Swiss National Bank. This created the perfect scenario with 90% of positioning long the Euro against the Franc. The ensuing losses took out FXCM a large trading firm after a $225 million loss. The trade setup is shown below. Today this sits at one Euro per 0.94 Francs.

September 11, 2001 Attacks

The terrorist attack on the World Trade Center, Pentagon, and United Airlines Flight 93 occurred just prior to the exchange open on September 11, 2001. In response, trading floors remained closed until September 17, the longest shutdown since the Great Depression. The opening went as expected, with a 7.1% loss for the Dow Jones index, its largest in history. Trend managers came into that event short based on the previous week’s declines and did well. Others were caught offsides and lost over $1.4 trillion a single week.

Israel-Iran conflict (2024)

On October 26, 2024, Israel delivered an expected attack on Iran. Fears that they would bomb oil fields and refineries to deprive that regime of needed revenue were in naught as they concentrated on military targets and the degradation of their ballistic missile capabilities. Iran, humbled by the ease at which the Israeli Air Force operated, wisely decided not to retaliate. With the threat of future disruption minimized, oil dropped 5.23% ($3.75) on the open. Depending on the look-back period, traders were either short already on longer time frames or betting on a rise in recent patterns.

Risk Management Strategies for Traders

It is important to understand how a manager could prepare the scenario above. Most trades today have a set exit point called a “stop loss” for risk management. This level might have been set at $70 a barrel using the example above. A sell order is automatically generated if the market drops to that number. In this case, the value skipped that number and dropped to $67.93. Systematic traders often program logic to re-check the new price to ensure accuracy and then enter a market order to get out as soon as possible. Others might get an alarm to trade the position and perhaps take the other side manually. Ultimately, the only way to truly be guaranteed to exit at a set point is to use long options as a hedge, which can get expensive. This is generally avoided based on the rarity of these events.

Impact of Extended Trading Hours

The New York Stock Exchange (NYSE) recently announced a plan to be open for trading 22 hours a day. This matches the futures market, which rarely closes. Longer hours reduce some potential for these “gap trades,” in theory. The counterargument is that volume will further dilute across the day and night, which might increase the frequency of sharp moves. This is what we see now, with future volumes lower at night. Systematic trading makes it easier to go uninterrupted and manage these swings in a 24-hour cycle. Foreign trading would likely increase as the open period finally matches their waking hours. Companies might also be attracted to a larger investor pool when they decide to list on an exchange. One guarantee is that it will make more money for the NYSE.

Preparing for the Unexpected

An adage that remains true in the trading world is to expect the unexpected. This means thinking through the worst-case scenarios and doing what you can to plan accordingly. You can end up on either side of a trade through pure luck. Over time, the odds even out. Position management, which includes sizing, stop loss levels, and not getting overweight to one sector, can help. Regardless of which side you begin on, dislocations often provide immense opportunity. Like life, it isn’t what happens to you but how you respond that matters.

Please email or call with any trading questions or to learn more about our futures traders.

Photo by Patrick Weissenberger on Unsplash