Two weeks ago in our note titled “Markets have to adjust as Fed alters course”, we said the following; “…The Fed is continuously worried about upsetting financial markets if they remove the punch bowl. They are also now worried about Dollar strength, vulnerable global growth, low commodity prices and political uncertainties. Despite the rally in asset prices in the last two months or so, none of these uncertainties have actually been resolved, and so it is unclear why the Fed have altered their narrative this week…”

A few days later, Janet Yellen spoke, and although she was not as specific as many of her colleagues in calling for two or three rate rises this year, she did say that a “rate hike in coming months may be appropriate” with the usual caveat of data dependency. The key point for us at the time was that at the beginning of May, there was no pressure on the Fed to raise rates at all. The recent re-pricing in the market was entirely due to communications from the Fed.

Fast forward two weeks to today, and after a truly disappointing US employment report, the market has priced out any rate hike in coming months, with only slightly more than a 50% probability of one rate rise by year end. In our opinion, Janet Yellen has always been a lot more dovish than a number of her colleagues and will not want to raise rates now. So, either the Fed ignores the poor US employment report (and the continuing weakness in the manufacturing sector and corporate profitability) and raise rates anyway, thereby risking upsetting the financial markets. Or, they shift back to a more dovish narrative, risking their credibility.

Now, we have definitely been on the more bearish economic case for a good few quarters, primarily because of the slowdown and then decline in corporate profits and the leading indicator qualities this has historically held. So, a poor employment report at some point had been due. However, before we get too enthusiastic about positioning our portfolios for a world where the Fed is on the sidelines, we need to consider the case for a strong whiff of stagflation in the latter part of this year.

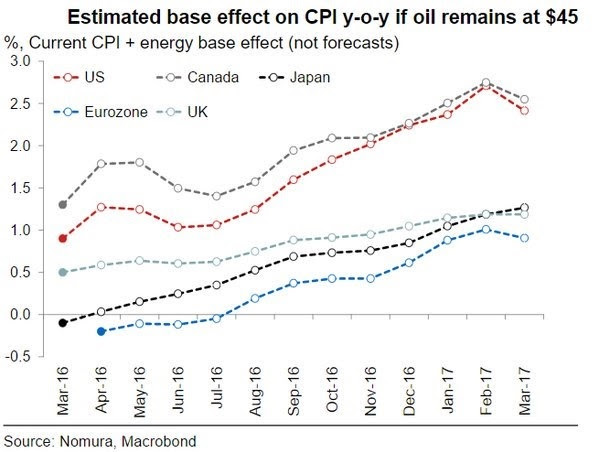

The chart below that we showed a few weeks ago shows the potential trajectory for inflation in selected countries assuming the price of oil stays at $45. What is clear is that inflation is likely to be heading demonstrably higher by late summer, and with the Fed’s employment mandate basically now achieved, rising inflation should lead the Fed to rate normalisation. Will the Fed really be able to stand pat with both their mandates being met, even if growth is slow?

Back to our report from two weeks ago. We finished by saying that “The altered Fed policy makes for a very interesting period ahead, quite possibly an increased level of global volatility and difficult markets… Confidence in markets, policymakers and the outlook for the global economy is pretty fragile, and it only takes one or two small upsets in this sort of environment to really throw a spanner in the works…[we are] watching the Fed very carefully for any backtracking from their new found hawkish bias.”

In terms of our big picture thinking, we are comfortable with the stagflation scenario for later this year. Our view is that if the Fed do raise rates as they articulated in recent weeks, then this will flatten the yield curve, strengthen the Dollar and likely be part of the tapestry of indicators we look for when thinking of imminent recession. So, the big question is can the Fed keep rates low enough to help enable modest growth and inflation, alongside stable to rising financial markets and sufficient jobs and wages growth to neutralise the wealth/income inequality debate during the US election campaign? Quite a task considering the Fed’s forecasting track record.

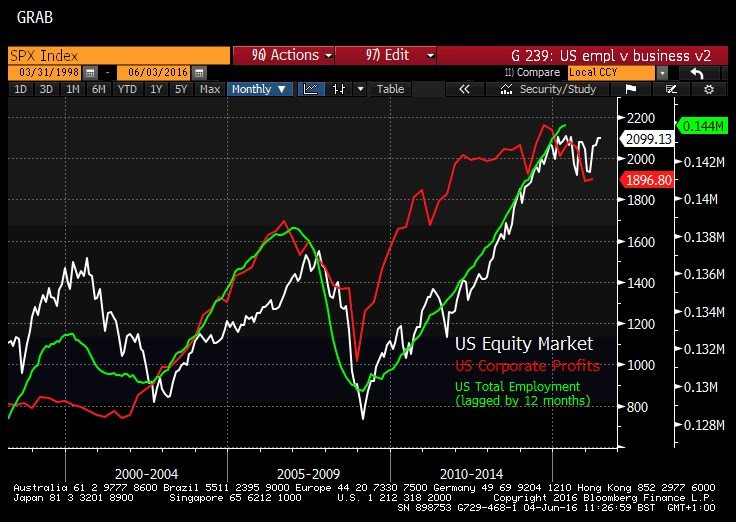

As noted above, the performance of corporate profits is a good leading indicator for the economy. In the chart below, we compare corporate profits with total employment (lagged by 12 months) and the US stock market.

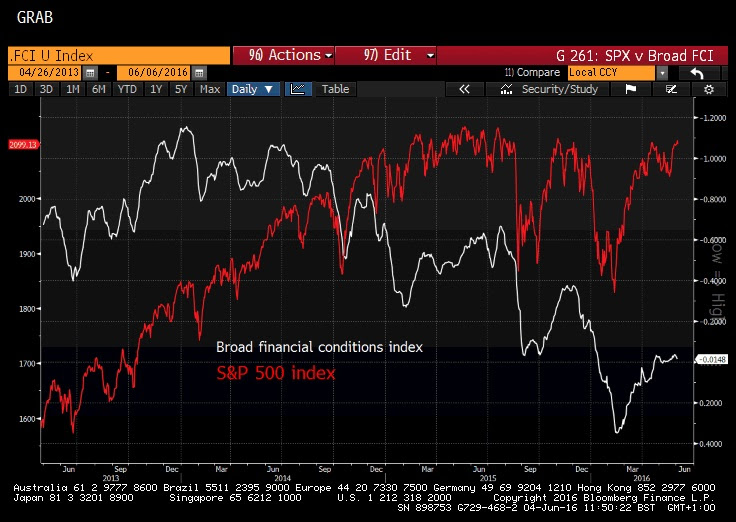

Corporate profits peaked in Q3 2014 and are expected to decline again in the second quarter of this year. It would appear after the poor employment report that total employment may very well be close to peaking, just about bang on schedule. In this analysis, the next shoe to drop will be the US equity market, which appears to be running on fumes. The chart below shows the US equity market and a composite indicator of 5 financial conditions indicators. If the US equity market starts going down, and drags credit spreads higher as is usually the case, the financial conditions will deteriorate. We continue to strongly believe that an equity bear market will be final nail in the coffin for this economic expansion.

So again, the only way financial conditions can remain stable is for the prices of corporate assets to remain steady or higher, despite extremely stretched valuations, declining corporate profits, aggressive use of leverage for buybacks and M&A and the growing acceptance of central banking impotence.

Our main scenario remains that there are any number of ticking time bombs around the world ready to explode at any time. Policymakers have somehow managed to keep the investment community happy with extremely unorthodox policies forcing a record hunt for yield and mis-allocation of capital. However, growth remains too low and insufficient to generate the cash flows necessary to service both outstanding debt and equity holders.

Central bankers probably do not have sufficient firepower to prevent the next global recession when one of the ticking time bombs explodes. Yes, they will do all they can which means that the day of reckoning could be delayed for longer than the bears would like. However, the basic laws of finance and economics cannot be repealed forever. The poor US employment report is a sign that US growth is simply not as strong as the Fed would have us believe, and they have no ammunition in the event of a recession. If they choose to ignore the slow growth, and raise rates because inflation is picking up, then they will likely be making a large policy error from which they will struggle to recover their credibility.

Stewart Richardson – Chief Investment Officer

RMG is a London-based manager of global macro and foreign exchange strategies designed to generate absolute return for investors. Many years’ experience in managing strategies targeting absolute return focuses the fund managers on both identifying tactical opportunities and managing risk to protect against surprises. The strategies are built on understanding global economies and financial markets.