A provocative post by Peter Lupoff the founder of Tiburon Capital called “When numbers cloud meaning – The fallacy of investment research exactitude” has me thinking about narrative versus the idea of false precision with quantitative analysis. First, something to put the issue into context; a classic joke on false precision, “I am 98.54% certain that you need both precision and narrative to be an effective trader.”

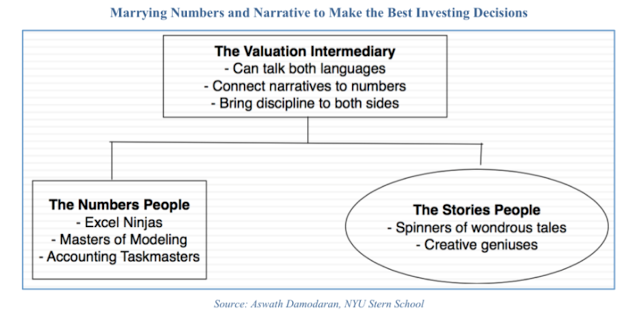

Quant analysis without narrative is lifeless, and narrative without data is just providing opinions without support. We can be precise in pricing derivatives, but we may not know whether these derivatives are valuable. We can forecast exchange rates using past money and interest rate data, but we may not understand the next move by the Fed. We may have data that say stock CAPE is high, but we still may not know whether the market is rich given the environment.

Quant modeling can provide sensitive to a set of factors. It can generate levels of significance to historical data relationships, but it may not provide unique context with the current environment. The finance and accounting MBA’s can give you the numbers, but they may not tell you how to grow sales or develop new products.

Passive indexing, factor investing, and smart beta may help investor find effective base portfolios, but these portfolio tools may not help determine whether stocks or bonds are undervalued and ready for adjustment. To add portfolio value, there needs to be a story or narrative that tells something beyond the data as presented in the model framework. If you don’t have anything more to say with a narrative, the fallback position is quant analysis and data. There is nothing wrong with a reliance on quantitative analysis and it may be more effective than a poor narrative not grounded in history, but narrative can address the key issue of uncertainty.

Quantitative work sets the stage for a good narrative to explain the numbers and add something that has not been measured. The narrative is necessary because there are some current events or expected future events that cannot be effectively expressed in past data. Uncertainty is different than risk, which can be measured with a quant model. Once there is a need to address issues beyond risk there is a need for narrative. Quantitative work handles the risk and narrative address uncertainty.