Tail events will often lead to over-reaction as seen in the market action overnight. The worth of a manager is not measured by his ability to build and adjust portfolios in calm times but his ability to navigate and manage through uncertainty.

Navigating uncertainty is not always taking action but at times learning to do nothing. Discussion with managers suggests that some systematic managers did not take model signals last night. Markets moves out of proportion to the discounted futures cash flows signaled that no action was best.

Managing uncertainty starts with core portfolio construction. Extra diversification is necessary when there is extra risk. Diversification may come through differences in timeframe and styles when correlations across asset classes have the likelihood of moving to one. Managers are paid to build portfolios, manage risk, and take action on changes in economic fundamentals, this cannot generally be done with passive investing.

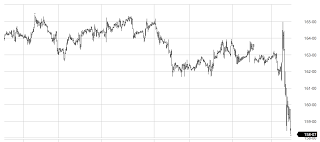

A Black Swan? I don’t think so now that we are looking a few hours out from the event. As an event that will rock the market, this met the case based on short-term flows but not by longer-term measures at least with respect to stocks. The chart for Dec S&P futures shows a huge intraday move, but now within some measures of trend. Bond markets sold-off hard under huge volume. This is the asset class to watch more closely.

Tail events will often lead to over-reaction as seen in the market action overnight. The worth of a manager is not measured by his ability to build and adjust portfolios in calm times but his ability to navigate and manage through uncertainty.

Navigating uncertainty is not always taking action but at times learning to do nothing. Discussion with managers suggests that some systematic managers did not take model signals last night. Markets moves out of proportion to the discounted futures cash flows signaled that no action was best.

Managing uncertainty starts with core portfolio construction. Extra diversification is necessary when there is extra risk. Diversification may come through differences in timeframe and styles when correlations across asset classes have the likelihood of moving to one. Managers are paid to build portfolios, manage risk, and take action on changes in economic fundamentals, this cannot generally be done with passive investing.