A review of all sectors shows some clear themes across asset classes. Bonds are out of favor and US equities are preferred. International equities and bonds reflect repricing of rates and currencies while still showing lower global growth.

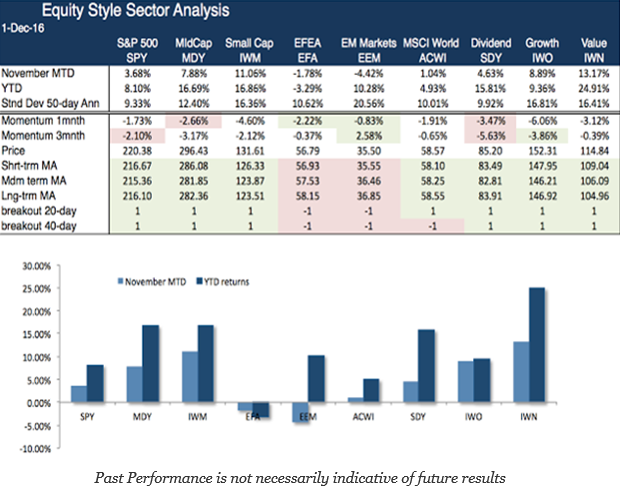

There were significant equity style performance differences with small cap and value showing strong gains versus large cap indices. Foreign markets and EM were the big losers as a stronger dollar, higher rates, and the potential for trade wars dampened investor expectations.

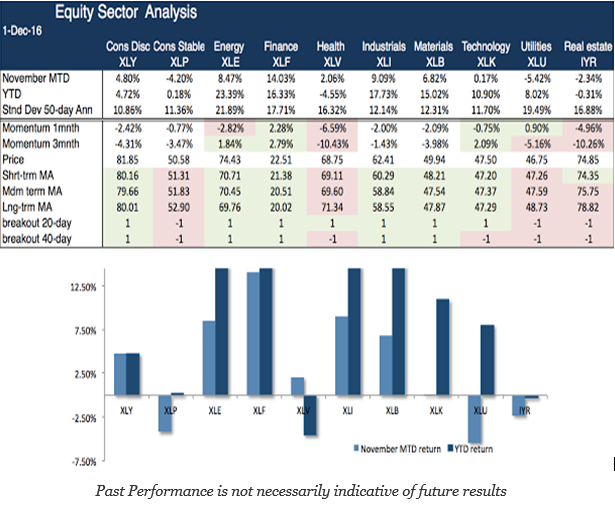

The best performing sectors were finance and industrials with strong gains also in energy and materials. Finance reflects the expectation that financial regulation will not get any worse. While industrials and energy reflect improved growth potential and higher oil prices. The worst performers were those sectors that are more sensitive to the level of interest rates, utilities and real estate. The stretch for yield may be over.

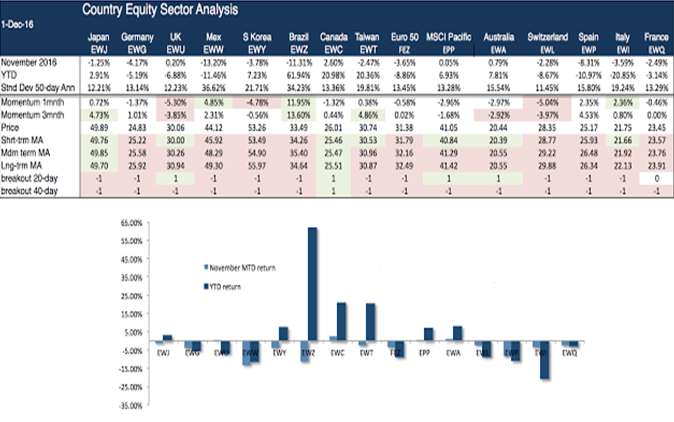

Country equity returns were generally negative with double digit loses in Mexico and Brazil. Mexico has been hurt by the expectations of Trump trade wars while Brazil was a retracement with all emerging markets after outsized year to date performance. Commodity focused countries like Canada and Australia did better on a relative basis.

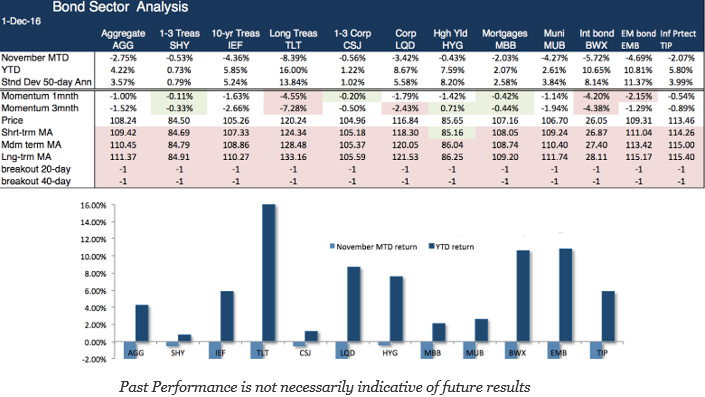

Bond performance was poor across the board for all sectors and indicators suggest that there will be little turn-around with these poor returns. Long duration hurt investor worst as well as international and emerging markets. The foreign bonds saw further erosion from the strong dollar. The only protection was in the high yield sector where there was continued tightening of spreads especially in the energy sector.