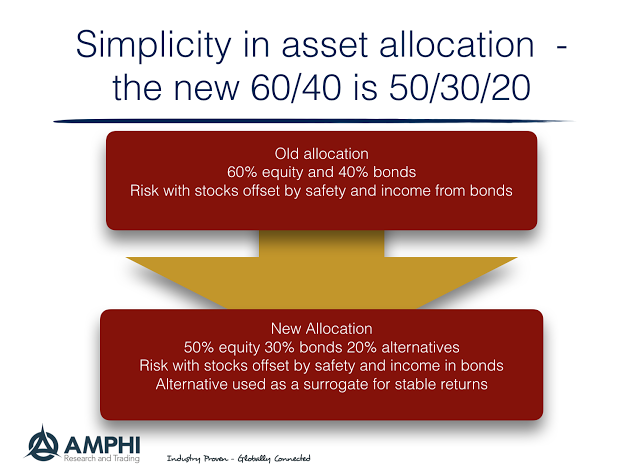

The rule of thumb used by many investors as a base portfolio allocation has been a 60%/40% stock/bond mix. When in doubt, investors are supposed to go with a standard 60/40 allocation as a safe base case. If you are going to change the allocation, measure the change against the base 60/40 mix. Investors can perhaps add international equity or international bonds or maybe a dash of commodities, but if there is more uncertainty, the safe action is to move back to 60/40. Many advisors may suggest something different, but then show why it would be better than the baseline 60/40 as the reason for its efficacy.

There is a new baseline vying for the attention of investors, the 50/30/20 mix, (50% equities. 30% bonds and 20% alternatives). This is the buzz I have been hearing at a recent pension fund conference. Is this the solution to all problems and that magically 7.5% rate used as a discount or expected return for pensions? I don’t think it will be the “holy grail” allocation but it solves some of the problems currently faced by pensions.

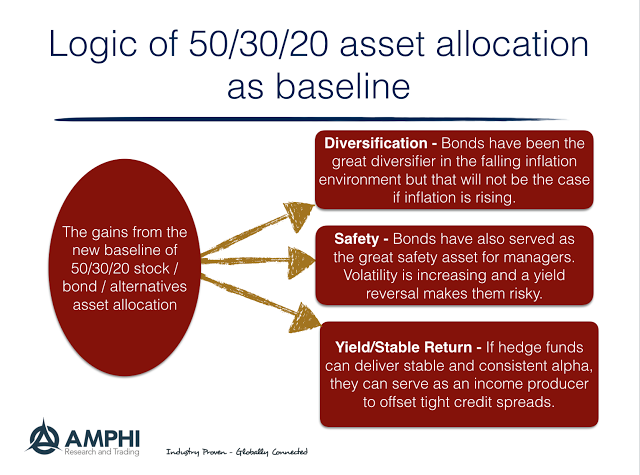

Problem 1: Diversification – Bonds will not be negative correlated forever. In fact,

Problem 2: Safety – A safe asset is not supposed to lose money. After the last month, we can say without hesitation that bonds can still lose money. There should be available other investment alternatives that can provide safety.

Problem 3: Current yield – Even with the yield back up, we are living in a low yielding world where bonds are not able to generate the income necessary to reach the target discount rates used by pensions.

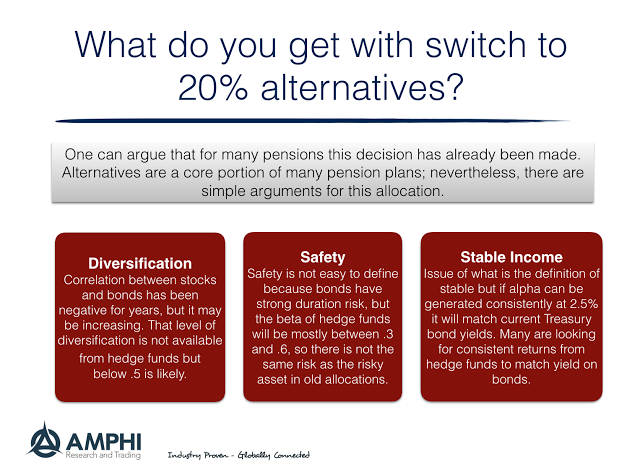

Solution 1: Diversification – Hedge funds provide the best diversification available with the exception of bonds for any portfolio. The gains from diversification will switch to hedge funds if there is a more inflationary environment.

Solution 2: Safety – Given the lower volatility and markets betas of hedge funds, they will generally offer lower risk and relative safety for investors. They certainly will not usually have the same bond duration risk seen in most fixed income allocations.

Solution 3: Current yield – The alpha generation from hedge funds can provide the potential for creating a stable return. While the consistency of alpha generation has been questioned, in theory, the concept of hedge funds is to produce smoother returns though less market exposure and the generation of alpha independent of market moves.

The basis for the change to 50/30/20 allocation from the 60/40 standard allocation is that 10% can be taken from both the fixed income and equity allocations yet still create an effective portfolio structure. The 10% from the fixed income allocation can be placed in diversifying hedge funds that can generate consistent returns and have risk similar to bonds. The 10% from equities is held in hedge funds that may have a .5 beta but also have the opportunity for alpha generation. In reality, the market exposure will actually give you a 55% allocation to equities, and if the market beta for the bond substitutes is closer to .3, the net effect will still be a market exposure that is close to the 60% in the standard allocation. The basic return characteristics can be kept the same while still allowing for upside return.

While there is more buzz concerning the new 50/30/20 allocation, we don’t think this is a radical change versus the standard 60%/40% core asset allocation. In fact, the approach may still be conservative and prudent if fixed income is buffeted by higher risk premiums and expected inflation.