The development of FX style betas has changed the way investors think about their foreign exchange trading exposure and risks. The approach is simple – trading risks in FX can be decomposed into four style factors, trend, carry, fundamentals, and volatility. The argument states that an investor can easily manage or decompose FX returns using these beta styles or strategies. It is an effective way to show how returns can be generated in currency markets.

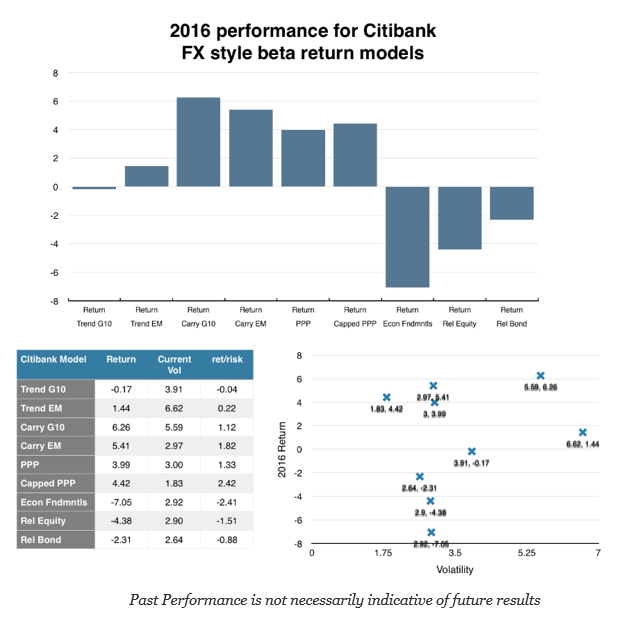

We can use the style currency betas developed by Citibank to measure how returns could have been generated in currency markets last year. Their style or model breakdown is much more extensive than most of the currency academic literature. The models provide a good set of style betas. The breakdown includes trend for G10 and EM, carry for G10 and EM, fundamentals, two forms of PPP, relative equity performance, and a trend differentials in interest rates.

The 2016 returns show positive gains in carry as the main style driver in returns. Carry, the classic standard for FX trading profits, is back after its demise during the GFC and the period of no interest rate differentials. Returns also seem to follow purchasing power parity although more extensive fundamental models proved to be a poor representation of currency behavior. In spite of the market uncertain this year, the wider dispersion in monetary policy and rates have lead to more opportunities in currency markets.