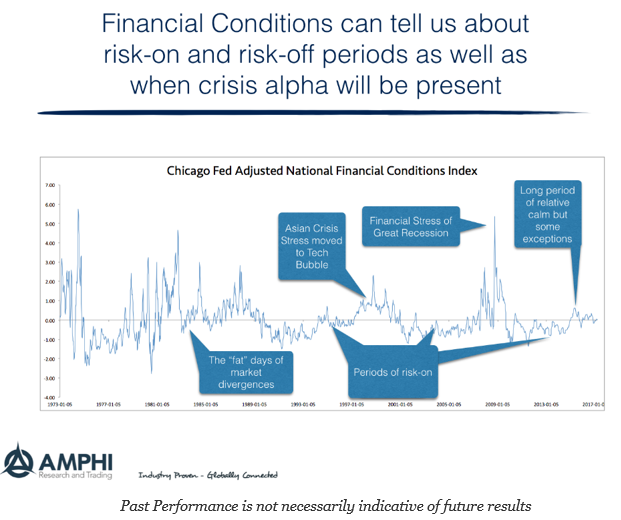

Financial conditions can inform us about periods when thises and market dislocations will occur. The graph above shows the time series for the Chicago Fed adjusted financial conditions index. The index measures liquidity, risk, leverage in money, debt, and equity markets, and traditional and shadowing banking measures. If the index is positive (negative), financial conditions are looser (tighter) than average. A close look will suggest that tight financial conditions correspond to periods when there has been a crisis. Generally, these have been periods when the markets are moving to or in a risk-off regime. The change in financial conditions tells us something about transition in markets. Financial conditions are tightening if the index moves from negative to positive. A decline in the index suggests that financial conditions are deteriorating.

During these transition periods, divergent strategies such as managed futures should do better than in other periods when financial conditions are good, and a risk-on regime exists. In particular, we are looking to see if tightening or deteriorating financial conditions are periods when managed futures do better than average.

We have conducted some simple statistical analysis and found that what may seem obvious on a graph may be harder to find when looking closely at the data. We divided financial conditions into subsets based on whether the index was positive or negative, moving higher or lower. We then compared these periods with the subsequent three-month returns for the BTOP 50 managed futures CTA index. Whether financial conditions are positive or negative does not matter, but the change in the financial conditions does matter. If financial conditions deteriorate, subsequent BTOP index returns will be stronger than non-deteriorating periods and the average three-month return. However, there is little difference in managed futures returns during periods when financial conditions are loosening. The tightening of financial conditions leads to more market divergences. Unfortunately, a simple significance test will find that these are not significantly different from the average at anywhere close to 90% confidence.

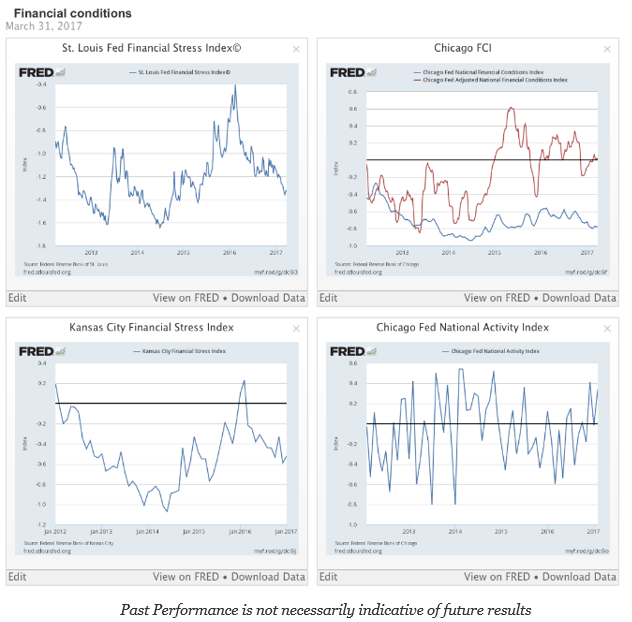

Right now, financial conditions seem to be looser than usual and not at all tightening. By this market description, managed futures returns, as measured by the largest managers, usually trend-followers, will fall into a normal range.