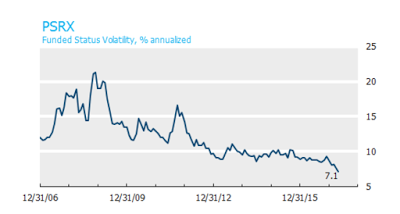

The Funded Status Volatility index (PSRX) from NISA is a useful tool for understanding pension risk exposures. It is an aggregate of the risks for pension based on the combination of assets and liabilities associated average allocations for the 100 largest pension funds as measured through public information and 10-k filings. The index, which represents $1 trillion in AUM, will move up and down with the volatility of all asset classes. Hence, falling equity and bond volatility as well as changes in the discount rates will translate into a falling PSRX index.

Still, the starkness of the volatility decline in the index is telling. There is less risk with the funding status of pensions but this also means there is less upside potential. The risk of seeing a large change in your poor funding status is about 50% lower than what it was 10 years ago. For the underfunded, pension problems will not go away. Those in good financial shape can sleep well at night. Yet, if we move back to the good old days of 10 years ago, there will be a lot of pension risk.

This low volatility environment has generated a search for holy grail investments – good returns with the ability to provide diversification. If volatility is headed higher, pension will want something that can dampen risk. If volatility stays low, pension will want some absolute returns to help get out of their underfunded status. Find me unique managers who can make money!

Where are these managers? They have to be iconoclasts who will take risks and not be like everyone else. Unfortunately finding these managers is not easy. To offer diversification and return, these managers may have higher stand alone volatility, larger active shares versus a benchmark or peers, and a willingness to be nimble in the face of changes in risks and economic cycles. A safe manager which has appeal to the masses is not needed. Yet, with fewer hedge fund start-ups, growing consolidation, and a focus on asset gathering by many successful managers, investment risk-taking is less likely.