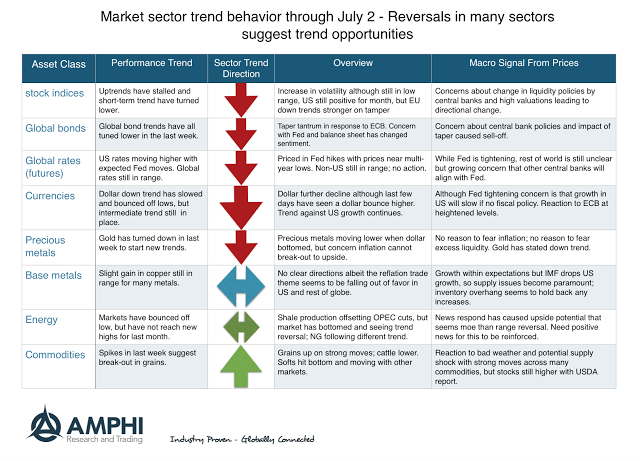

Trend traders were hit with a number of significant reversals in major asset classes near the end of the month. Bonds were rocked with a possible ECB “taper tantrum” albeit it is early to say that this will be like what was seen in the US. No two market tantrums will ever be the same. Equities are in a trend decline in Europe and the US has started to trend lower although the month still generated positive gains for many investors. There is an equity rotation away from large cap indices, but it is hard to take advantage of in futures. The dollar also trended lower near the end of the month only to see some gains in the last two trading sessions. Many commodities moved higher on weaker supply reports and oil products has bounced off the declines from the past few weeks. Last week was the major reversal period.

It is clear that loses will have to be taken when markets reverse trends. Being non-predictive, trend-following always gives back some profits when there are major changes across an asset class. The issue is always whether the development of new trends will generate enough profits to more than offset the loses from reversal. Trends need time to develop in order to generate profits. Opportunities are often based on the fact that a number of markets within a sector seem to all being giving the same signal. Our trend sector monitor suggests that the breath of markets showing reversals and signaling new trends indicates that there may be good profit opportunities this month. Traders can be fooled but there is a growing change in market sentiment that may turn buyers cautious.