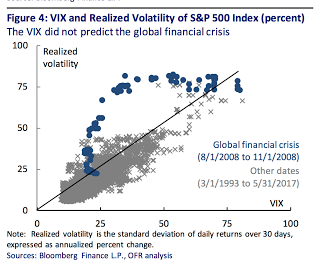

A provocative chart from the research piece The Volatility Paradox: Tranquil Markets May Harbor Hidden Risks by the Office of Financial Research Markets Monitor shows the poor forecasting of volatility when there is a regime change. Of course, tranquil markets harbor hidden risks. Low volatility is pricing in a lack of imagination of what the future may hold. The markets usually say that tomorrow’s change will be represented by the deviations of yesterday. We have learned from reading Minsky that low volatility will lead to risk-seeking behavior as investors reach for yield, employ leverage, and become complacent. Hence, a shift in regime will lead to more dramatic change in volatility.

Nevertheless, the most telling part of this chart is that when the big transitions come, the VIX index will not fully anticipate the move and realized volatility will move faster than the market’s ability to discount regime change. When market volatility reverses, the move is swift, so asset allocations for these types of events have to be structured today and not when the event is occurring. The cost for preparing a defensive diversified portfolio is the potential performance drag waiting for a big market reversal.