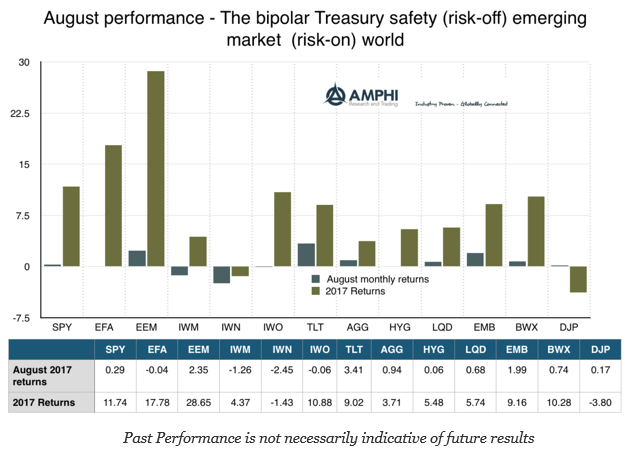

Global returns in August were unusual because of the bipolar behavior across market sectors. The strong performance on the long-end of the Treasury curve coupled with the negative returns for small cap and value suggests there was a flight to safety by investors, yet one the best performing sectors was the riskier emerging markets sector.

While there was an upward revision for US growth in the second quarter, the greater uncertainty concerning tax reform or cuts has weighed heavy on gains in equities. The switch from sell-off to return improvement during the month could be linked to a change in sentiment on this key issue. Negative sentiment concerning tax reform sinks the market while stories about a consensus for tax reform pushes the market higher. This issue focus uncertainty is not present in emerging market equities where good growth continues. International investments generally performed better on the dollar decline; nevertheless, as the currencies like the Euro move higher and seem especially stretched, there is a concern that it will negatively feedback on sales for these foreign companies.

With the end of summer, the focus is going to be on monetary policy with key meetings at the Fed and ECB in September. The Jackson Hole conference was a bust with respect to newsworthy announcements. The investment themes developed during the summer concerning overvaluation and policy direction will continue to be front and center for the fall. Still, the markets have shown a surprisingly level of stability given geopolitical and economic risks.