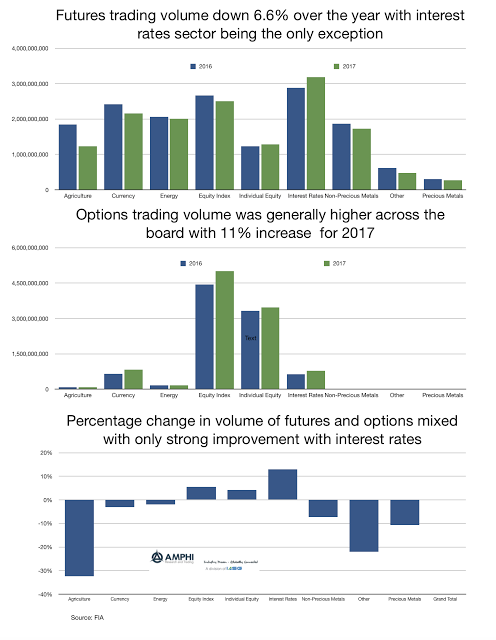

Global financial markets performed very well but you could not tell by looking at the volume of trading on futures exchanges around the world. The year-end numbers from the Futures Industry Association (FIA) show that futures trading volume was down over 6%. Options volume was up 11% and overall futures and options volume was flat for the year.

If there is no volatility and one directional markets, there will be less trading. There needs to be uncertainty for speculators to make bets based on disagreement of expectations, and there needs to be a reason for hedging for hedgers to trade on the futures exchanges.

The only exception for the low trading volume was in the interest rate complex. If the Fed is normalizing, there is now a two-way market for hedgers and speculators which leads to more trading volume. Eurodollars are making a comeback with trading.

In option land, the big increases in volume have come in the equity index sector which saw fear in some institutional investors who wanted to buy cheap protection against a downturn that has not yet happened. There also was stronger option trading value in currencies and interest rates based on the move to Fed normalization.

Expect a greater increase in volume for 2018 with the move to normalization by central banks continuing and a potential for more two-way trading in equity markets. Our view that the world will become more normal which means more peaks and valleys in market prices that will lead to increases in trading volume.

Download the AMPHI Research and Trading report: Peaks and Valleys on the Road to Normalcy in 2018?