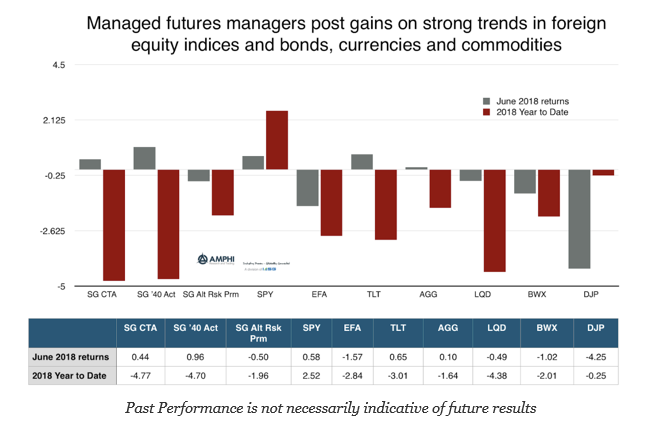

Based on the performance of the SocGen indices, the average managed futures fund generated positive returns for June. The performance of the Barclays BTOP also was up 59 bps and is only down three percent for the year. Managed futures outperformed all of the major asset class ETFs based on strong trends across a number of asset classes.

While US equities still showed a gain for the month, global equity indices offered opportunities from sell futures short. Although the dollar rally seems to have slowed, foreign exchange was a strong sector for trading gains. Bonds prices rose above many moving averages and were another source of profits. Profits were also generated from the continued increase in energy prices. Commodities and metals were sectors which showed strong negative trends.

Given a review of the June trends, it is actually surprising that managers did not make more money this month. The strength of these sector trends suggests that July may also be a profitable month.

We have seen a growing interest in Alternative Risk Premiums (ARP), so we have added a performance column to show gains and losses for this strategy area of growing importance. The SocGen ARP index looks at a leading set of funds which focus on ARPs. The index was down for the month and is down approximately 2% for the year. These numbers are consistent with some well-diversified bank alternative risk index indices. The key ARP driver for 2018 has been the volatility spike in February. Volatility carry ARPs which are usually short vol, underperformed in February and have not been able to generate enough to offset those earlier loses.