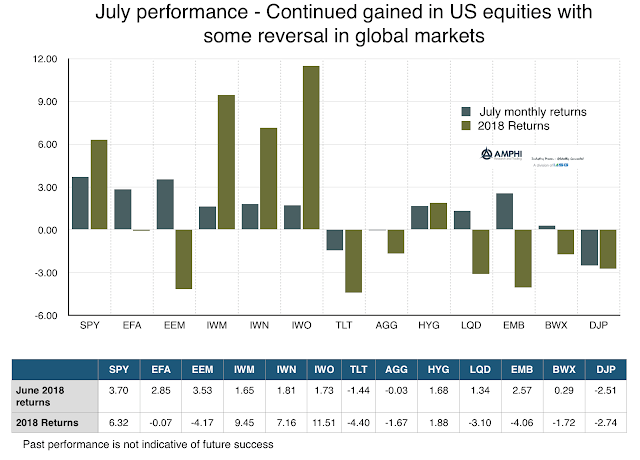

First look at the data to see what weighted market opinion is telling us. July marks a reversal to more risk-on behavior with strong gains in large cap US stocks as well as international and emerging market equities. While small cap, growth, and value indices all did well, the broader international concerns affecting risk behavior have abated. This positive global view was also seen in the international bond markets. The dollar rise from a desire for safety was contained and more range bound. Along with international bonds, credit markets improved with tightening spreads. The only losers for the bond sector were long-duration Treasuries and commodities.

Away from the headline grabbing FAANG stocks, the markets have responded to the higher economic growth story which culminated with a 4% second quarter growth announcement. The combination of continued good economic news and a dampening of trade war rhetoric led to a more hopeful market. While trade war discussions with China are still a market focus, the news with the EU is more suggestive of compromise or even a new trade deal with better terms. Of course, these trade discussions almost always exclude autos and agriculture which are industries that hold special appeal by the EU.

While the link between economic growth and equity prices is not always definitive, we can say that the announcements of tech firms like Facebook, Netflix, or Twitter do not represent signals for where earnings will go for the average firm. The growth story and its impact on wages and inflation will still be the key driver for the rest of 2018.