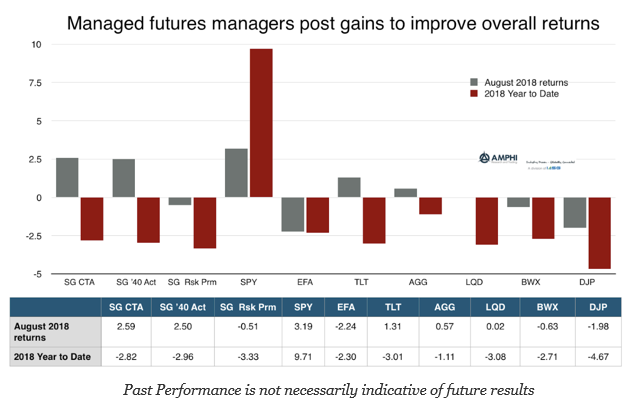

Managed futures showed good returns for August with gains in both stock indices and bonds. Given size and liquidity, as equity and global bonds goes, so goes CTA performance; however, there were also gains in selling grain markets and taking advantage of shorter-term trends in the energy sector. Other CTA indices like the BTOP50 also showed strong gains for August and similar year to date numbers at -2.66 percent. The SG alternative risk premia was down slightly for the month.

CTA indices have not performed well versus equities this year, but style excess returns, when double digit equity benchmark returns are seen, are rarely expected. Diversification will smooth returns when there is a strong long directional market. However, the CTA benchmark is better than long duration Treasury, international and emerging market bonds, and commodity benchmark ETFs. CTA’s are proving to be an adequate diversifier and not a drag on performance relative to other diversifiers.