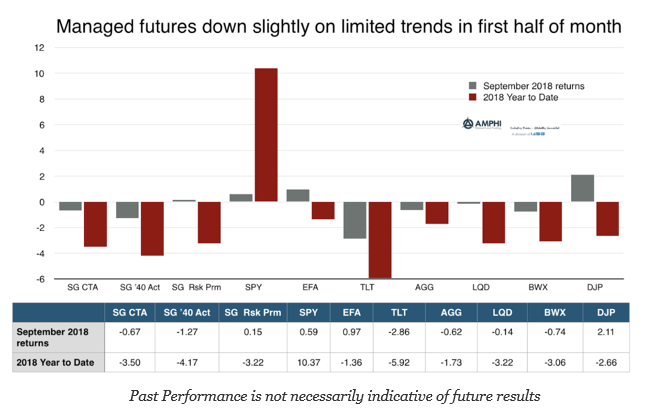

Managed futures, as measured by the SocGen CTA index, showed a slight decline in return for the month, but this performance within the range of most asset classes with the exception of equities. Being long market beta is still king for the year with little absolute performance value from diversification.

Managed futures, in general, may have been able to exploit trend opportunities in bonds, rates, and energy based on our assessment of market behavior in September; nevertheless, the mixed range of price action during the first half of the month may have limited return potential. Managed futures have shown similar performance against a diversified portfolio of risk premia which have suffered from the sharp corrections in volatility earlier in the year.

With only a quarter of the year left, strong positive gains for managed futures will be dependent on some form of market dislocation that will spill-over to the large traditional assets. While many have noted there are asset price excesses in both equities and bonds, there is limited information to suggest a market dislocation is imminent.