A big problem with macro fundamental investing is getting timely data on the economy and then translating that information to effective investment signals. Government issued data generally are out of date and old information for forward looking forecasts. Hence, there is greater value on macro data that is current and prospective.

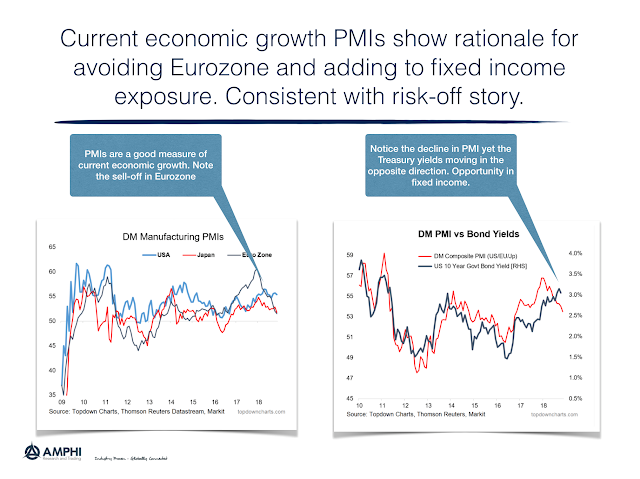

The PMI forecasts, which are announced monthly, are a good macro candidate given they are measured across a broad number of countries, have significant history, and are forward-looking expectations of economic activity.

A graphically analysis of PMI explains the major sell-off in European equities relative to the US. It can also explain the decline in EM equity valuation. Similarly the PMI forecasts can tell us something about the broad trends in bonds. If the PMI is declining (increasing), there should be a bond rally (decline). Rates fall during declines economic activity. Investors just have to get an early signal. The current reading suggest that any switch away form equities should focus on bonds not cash.