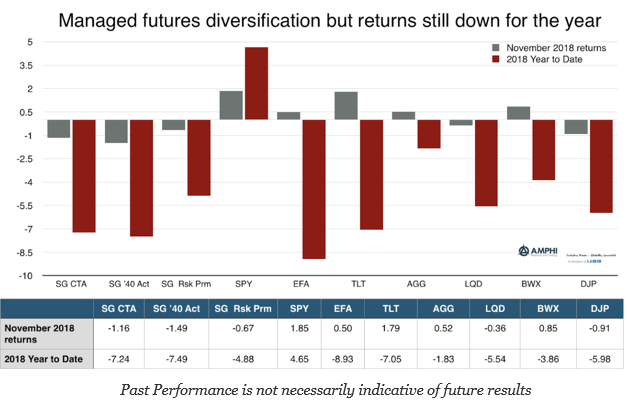

This was a negative month for managed futures funds as measured by peer indices for a simple reason, range bound behavior in equities and a reversal in bonds. Equity indices have started to trend higher, but longer-term trend followers were not able to effectively exploit these moves in the second half of the month. Global bonds have trended higher for most of the month but smaller position sizes based on higher volatility limited gains. Oil prices offered strong gains, but the size of positions may not have large enough to make an overall impact on fund returns. Commodity trades are generally a small portion of the total risk exposure for large funds.

Managed futures funds are unlikely to see a significant change in performance for the year in the next month albeit there are some stronger potential trends.