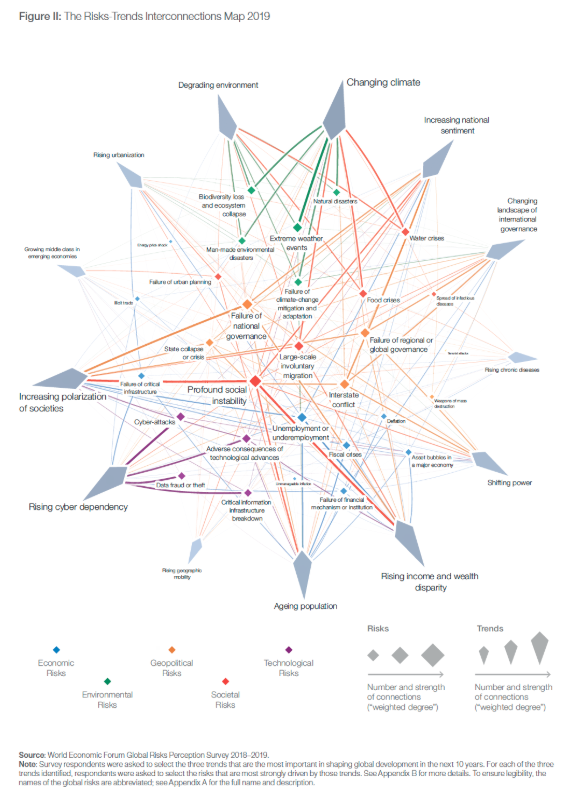

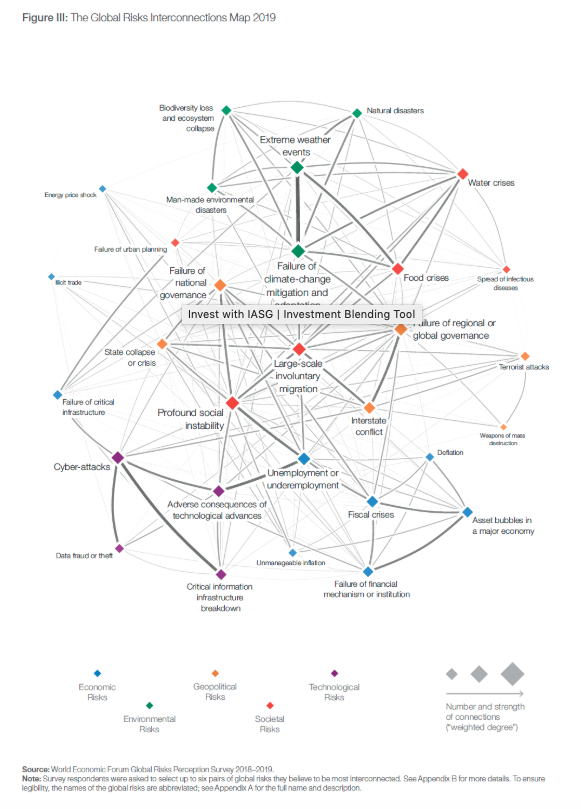

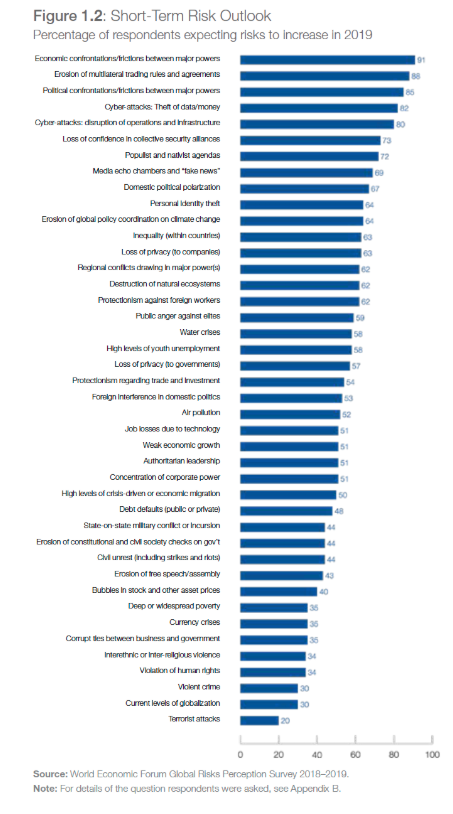

The World Economic Forum has produced their Global Risks Report 2019 (14th edition) this week. The report provides an exhaustive listing of the greatest potential threats to the global economy and discusses the potential linkages between these risks. The WEF describes five categories of risk: economic, environmental, geopolitical, societal, and technological. It is worth spending time getting their assessment although be warned that risks are everywhere and not going away. There is no good news with these potential threats. The report effectively shows how all of these risks are interconnected. There is no escaping from many of these global risks.

It is also clear that many of the current risks that are at the top of survey work are political and institutional. There is greater concern that the established order of government and international cooperation are under stress. In the short-run, there are also significant concerns with technology through cyber attacks.

After reading all of these threats and being better educated on risks, investors still have a to ask a simple question, “What should I do for protection?” We offer some simple advice.

These threats are long-term and not short-term opportunities. The top threats for the year may not see an actual risk event, so the focus should be on long-term portfolio construction.

- Diversification– Diversification should be on two dimensions, geographic and asset class. To account for longer-term risks, this diversification should be independent of short-term trends but should account for long-term valuation.

- Avoid country and firm leverage– Any country or firm that is highly levered will face greater costs with any risk event. Hence, leverage should be avoided.

- Hold long/short risk premia– Don’t think in terms of long-only diversification. Allow for investments in hedge funds and alternative risk premia that profit from downside events.

- Hold commodity exposure– For environmental and weather related risks, commodities are a good hedge. Climate shocks will lead to higher prices. Geopolitical shocks will disrupt energy and commodity logistics.

- Hold a diversified pool of cash– Investment in cash (currency) alternatives that allow for protection of purchasing power.

- Be comfortable with flight to quality investments– Treasury bonds and short-term fixed income unrelated to financial institutions.

- Allow for dynamic asset allocations– Long-term asset allocation is important but asset allocation should not be static. Markets change and allocation will need to change as risks arise.

The world is dangerous so protection of principal is critical.