Nobody likes paying for insurance. It is intangible as you pay up front for an unknown risk that may or may not materialize. Many of us feel that we overpay, until we really need it. It is perhaps not surprising then that many investors spend little effort protecting against sudden and unexpected drops in the market. After all, it is much like insurance. Intuitively you may know you need it but premiums can be tough to pay no matter what. But if we insure our vehicles, which represent a small part of our wealth, why wouldn’t we spend even more to protect our portfolios?

Parents of teenagers can relate to the particular shock of the change in premiums when they add their newly minted 16-year-old driver to their policy. Considering how myself and my friends drove when we were that age, I can confidently say that this makes total sense. Risk is also assessed based on the type of car and we all recognize what conditions are more likely to create accidents. Here in Chicago, weather, city parking, and rear end collisions are all likely to damage your car. So how would we assess the cost of an insurance policy on the market?

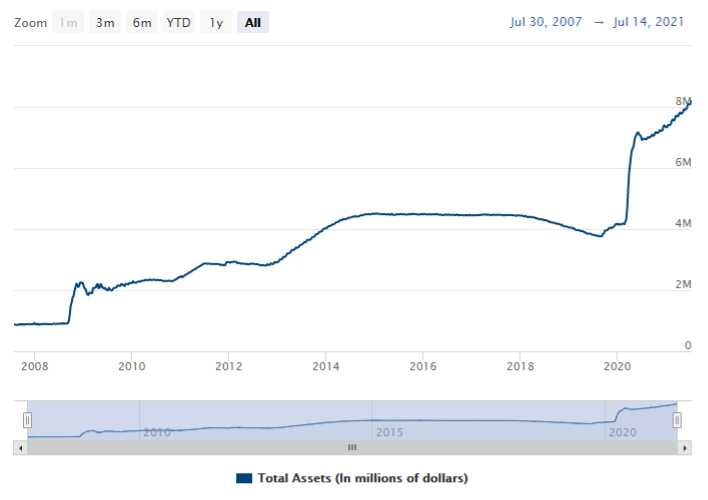

First, we would look at who is “driving the bus” (i.e. the market) to determine the risk. Jerome Powell, the Fed Chairman, would be the first driver to review. A simple chart of the growth in the total assets of the Federal Reserve shows the $4 trillion increase (100% growth from 2020). Unlike his predecessors, Powell is not considered an economist. He studied politics and law. While he seems responsible, it is possible that he skipped that requisite “driver’s education” for his job. So far, outside of a fender bender in 2018 when he prematurely raised rates (according to the market reaction) he has kept the ride very calm. He is up for re-nomination and the top goal of every politician is to be re-elected. Will this affect his decision making? After all the next person holds the keys.

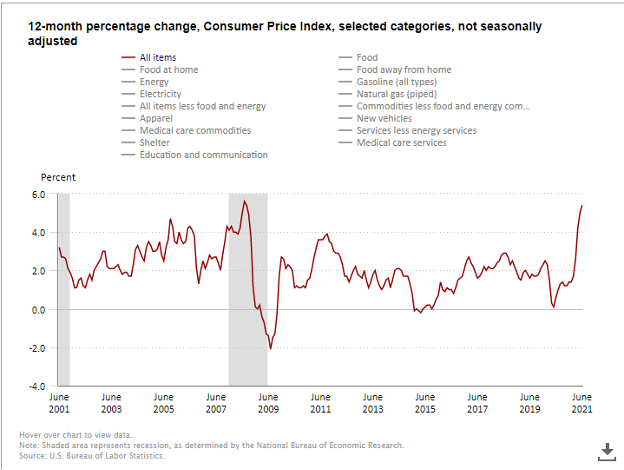

Joe Biden is one with enormous sway as well but also the political class as a whole. The US President’s recent comments, that passing a large budget increase in addition to approving a massive infrastructure deal will tame inflation is equivalent to saying that driving much faster will be safer. The chart below shows why skepticism might be warranted following a $2 trillion stimulus already this year. With thin majorities it will take all the Democrats or most with a few Republicans to get anything passed. Credit scores are often used to assess premiums. My guess is that both parties would pay a lot more for insurance if their spending habits were taken into account.

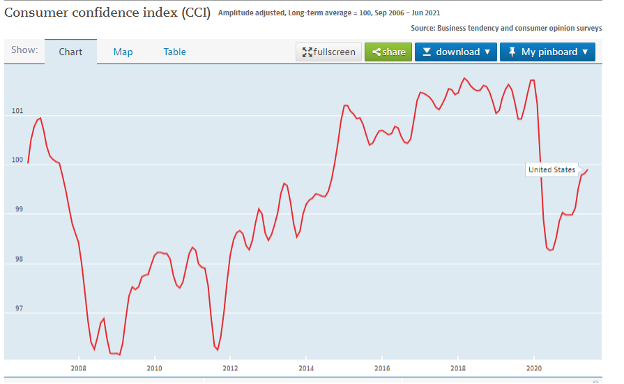

Finally, the consumer. We can look at the Consumer Confidence Index to determine how optimistic people are for the future. A reading over 100 shows that confidence is high and with a rosy outlook spending is more aggressive and savings rates are diminished. Currently, this sits just below that threshold, a period last occurring in 2014. Given the all-time market highs and a new housing boom we might expect this to be higher. Perhaps they are watching the other drivers and keeping their foot near the brake.

As a manager pointed out the other day, “risk doesn’t go away but it can be pushed into new time frames or areas.” We saw this with the housing crisis as home ownership created a boom and then a bust. We began the pandemic at record high markets and low unemployment but unbeknownst to us we were about to get into an accident. Index equity products might be affordable in comparison to a hedge fund or alternative investment fund but insurance is not cheap and you never know when you will need it. In fact, it might be frustrating to have for long periods. However, just like your automobile policy, it is best to have it in place before the wreck.

For more information on investments that can move independently of the market please reach out. I would be happy to answer any questions or show you programs that fit your needs. ~ Greg Taunt