As the saying goes, “In the land of the blind, the one-eyed man is king.” Right now, it appears that the United States, with its dollar strength relative to other countries, is king, which means we may be in serious trouble. The Fed continues to strive for a so-called “soft landing” where they strike the perfect balance of raising rates and unwinding their balance sheet. Results thus far appear to be lacking as we achieved yet another peak in inflation number of 8.6% in May, a new 40-year high.

We addressed the potential for inflation to accelerate in May 2021 in our article “Inflation Coming?” and predicted that hard assets would begin to rally. Even prior to the invasion of Ukraine, we saw energy and real estate soar along with risk assets like stocks and cryptocurrencies. While gasoline prices remain elevated, we are beginning to see signs of weakness across a number of other areas. Sadly, for the Fed and us, the next stage will probably be painful.

Correcting inflation is done simply by slowing an economy and reducing demand. A recession. While policymakers will avoid this term and hope that it is not “too bad,” it is clear their preferred policy-making tool might be to blame for the current state of affairs. As discussed in our Fed Pickle article, they can raise rates and reduce their balance sheet quickly to offset inflation or focus on full employment and avoiding a recession with a slower rate of increase. We predicted that the latter might result in higher material, energy, and labor costs and that they could strike the perfect balance if no events occurred to affect this balance. A disruptive war affecting commodity prices ended this possibility, with prices rising even faster than in the first quarter of 2022.

It appears the Fed is now embracing higher rates at the cost of high employment rates despite making the opposite choice just one year ago. With interest rates rising, housing demand is cooling, with residential mortgage origination dropping 18% from Q4 2021 to Q1 2022. Equity prices continue to fall. Food and energy costs disproportionally affect the lower end of the income scale, which is showing in reduced savings and plummeting consumer confidence. The chance of more energy supply coming online to alleviate prices is a topic for another article, but it appears unlikely that US drillers will do anything in the near term.

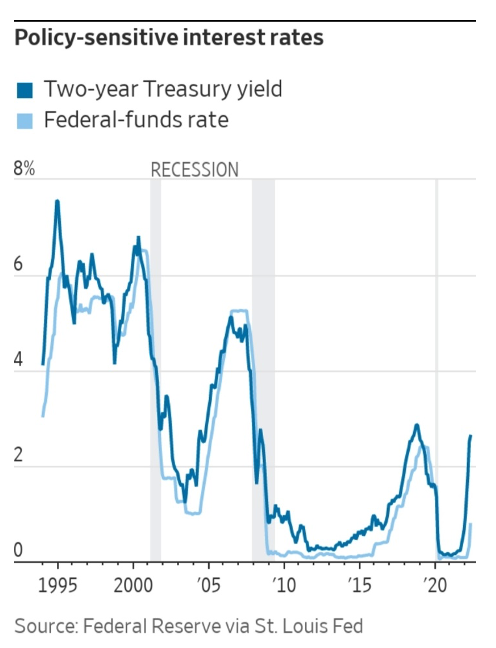

A recession reduces demand and wages as employees are let go as they were at the start of the pandemic. The chart below shows the cycle that normally plays out. You will notice that the recent rate peaks are lower each time before a recession is triggered. Often struggles begin at the bottom of the income scale and reverberate upwards (see 2008). So what happens next?

While I hope for surprises, the Fed seems to be behind the curve in raising rates and just started unwinding its balance sheet at a proposed rate of one trillion dollars a year. This prompted Jamie Dimon, CEO of JP Morgan, to comment that an economic “hurricane is right out there, down the road, coming our way.” Nobody can predict the future, but my advice remains the same, diversify your portfolio with assets that can perform in different environments. It is the only way to weather the storm and achieve a soft landing. I fear if you trust the Fed to do it for you, you may be disappointed.

References:

Photo by Marc-Olivier Jodoin on Unsplash