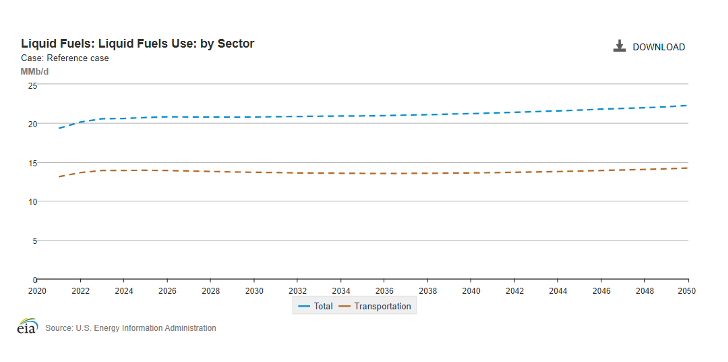

Much like Mark Twain, tales of the death of oil seem to be greatly exaggerated. In fact, the U.S. Energy Information Administration predicts that by the year 2050, we will be using slightly more fuel than we are now, with little change from year to year (see chart below). Famed investor Warren Buffet increased his Berkshire Hathaway stake in Occidental Petroleum by $250 million this month, which shows he agrees. With the advent of electric cars, some of this demand will simply shift to other energy sources, but we also use fuel for additional purposes that can drive demand. Let us cover some of the types of energy we use and how that might change going forward.

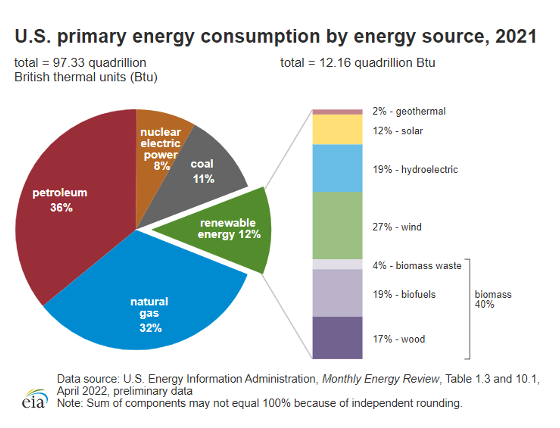

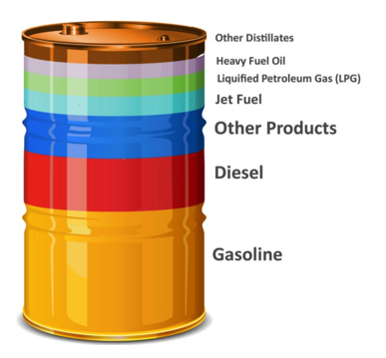

We can divide the energy world into three main groups. Carbon-based forms include petroleum, natural gas, and coal, while nuclear and renewables comprise the remaining portion. Electricity in the United States is generated mainly through natural gas, coal, renewables, and nuclear respectively. Petroleum is primarily responsible for transportation power. A standard 42-gallon barrel of oil (based initially on a 40-gallon whiskey barrel plus two gallons in case of spilling) is used for everything from gasoline and diesel to paint, tires, asphalt, and cosmetics. Natural gas is also an essential driver for synthetic fertilizer, which is used for crop growth and heating homes. Expect to hear more about the latter as Germany fights to stay warm amid a potential cut-off from Russian gas this winter.

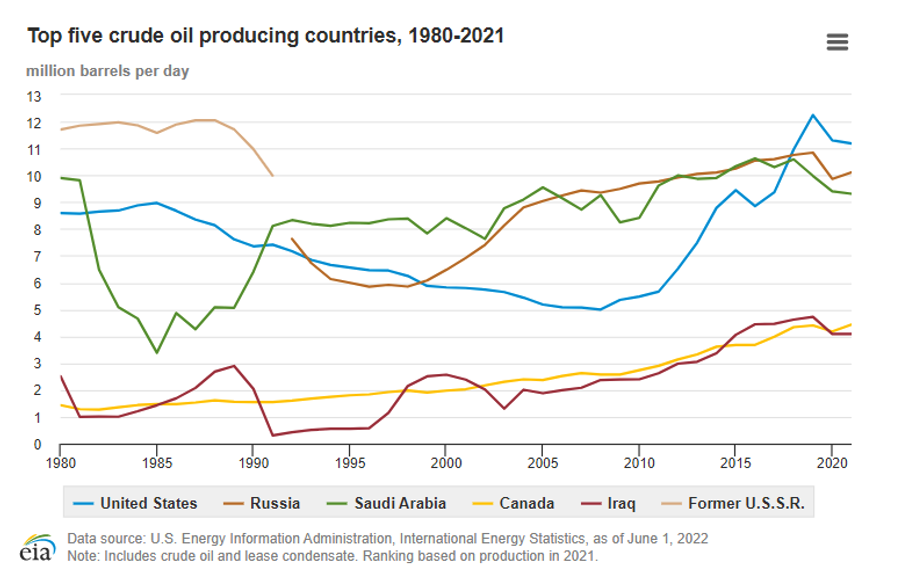

Supply for energy varies widely by type. Renewables provide well-known benefits for electricity, but depending on the strength of the sun, wind, or precipitation, it can be intermittent. Often this requires a backup supply from a more consistent form such as nuclear, coal, or natural gas. Crude needs to be discovered and then drilled for, which is capital intensive and, as discussed in our previous article, “War on Low Energy Prices,” requires $520 billion in energy investments each year.

Refinement is the next step in separating oil into its various components for use. Refineries can take up as much as several hundred football fields of space. Chevron CEO Mike Wirth says, “I personally don’t believe there will be a new petroleum refinery ever built in this country (USA) again.” Therefore, even if oil pumping increases, refinery capacity must also increase. Currently, in the United States, we have seven fewer refineries operating since 2019, reducing throughput by approximately 650,000 barrels daily. Reports say that few countries, including Saudi Arabia, Iran, and Venezuela, have additional capacity available.

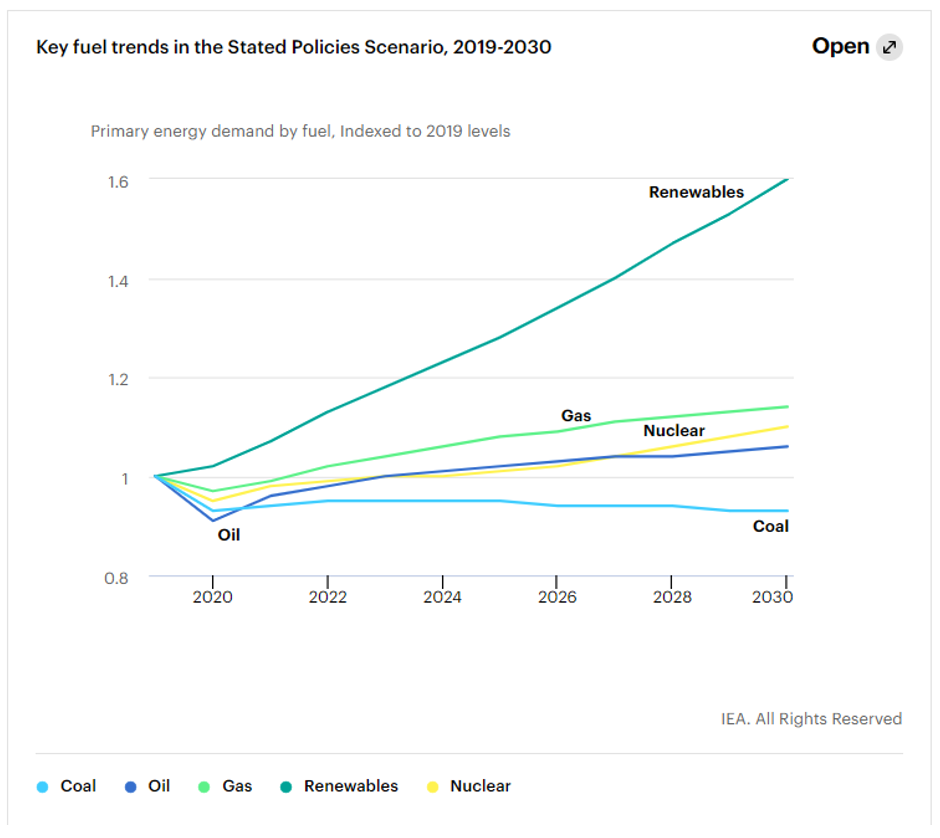

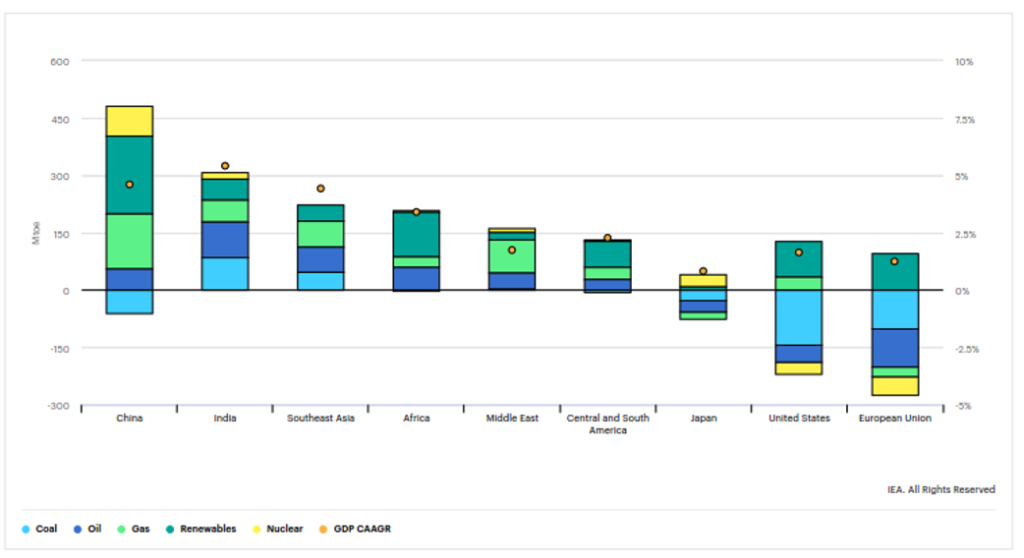

On the demand side, the IEA (2020) World Energy Outlook 2020 report shows that while almost all forms of energy see an increase, the desire for renewables increases the most. This is partly due to their relatively low production levels now but also through policy mandates, particularly in Europe and the United States. Countries tend to use more energy as they grow, and absent shrinking GDP is the trend we have seen play out for some time but accelerating since the 1950s and increasing 500% since that time. Programs to conserve energy may slow this rate, but developing countries do not want to sacrifice their prosperity. China and India, in particular, look to employ the “all of the above” strategy to power their economies.

Changes in primary energy demand by fuel and region in the Stated Policies Scenario, 2019-2030

The so-called “Renewables Revolution” may still be in its beginning stages, so these charts could change dramatically going forward, but the technology is not predicted to do much yet. Breakthroughs in battery storage or more efficient renewable energy sources encouraged by private and public investment might affect this outlook. In the meantime, traders like Cayler and Amapa look to take advantage of the volatility created by this shift. Sigma Advanced concentrates on the policy and renewables side through its Carbon Neutral Alpha Program. A portion of the fees generated from that program goes to benefit sustainability. Regardless of your thoughts, these changes create opportunities. If you want to add an investment that looks to capitalize on them, please reach out, and we can discuss your best options.