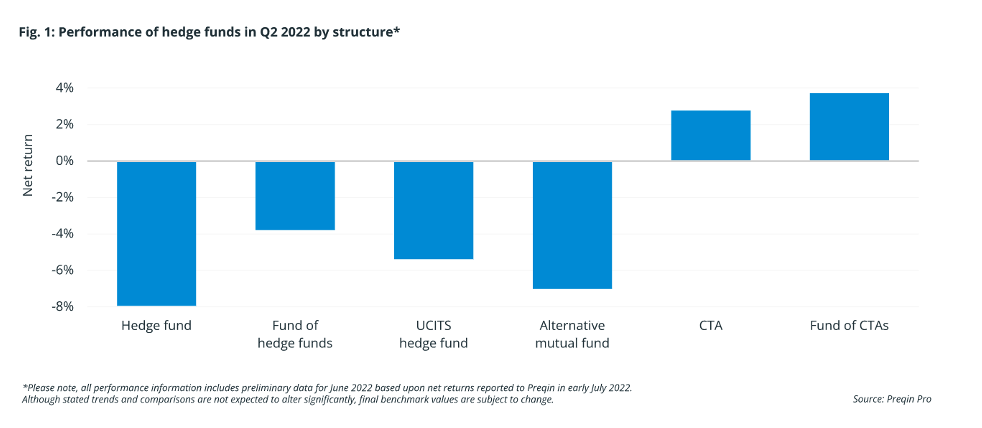

While the number of hedge fund types is virtually unlimited, all hedge funds are supposed to hedge risk (thus the name). Many investors believe this means that their investment with these managers will turn a profit when the rest of their portfolio is losing. The chart below proves this is not the case. The reason? Most hedge funds are much better at trading the long side of the market than the short.

Past performance is not necessarily indicative of future results. The risk of loss in trading commodity futures, options, and foreign exchange (“forex”) is substantial.

One asset class jumps out on this chart: CTAs (commodity trading advisors). As our previous article on hedge funds covered, most of those vehicles are a combination of Beta (market risk) and Alpha (edge over the market). This makes sense as the Beta portion, which is long equities, suffered during the selloff, and the Alpha did not fully cover the loss. On the other hand, futures traders often have a Beta near zero as they often have little to no market exposure, and if they do, they can easily be long or short. Unlike hedge funds, they tend to be MUCH better at trading the market short. This occurs for two reasons; the first is that every futures trade is long or short. Each side of a trade simply offsets the other in a zero-sum match. Unlike hedge funds, going short does not require additional structuring to execute. In the stock world, one must borrow existing shares to short, which can lead to a short squeeze (Gamestop). Second, the environment in which short trades excel tends to be volatile, and futures traders thrive on volatility. Simply put, they do not care where movement occurs as long as it is happening. Obviously, this is not always the case, but “crisis alpha” is a recurring theme across this asset class.

This return profile frustrates some investors when their equity portfolio is doing well but can be worthwhile when we see a decline. As a wise man once told me, if everything in your portfolio is going up at the same time, you have a bad portfolio. Many investors who choose hedge funds to diversify their equity portfolio are surprised to find that they have just that, a “bad portfolio.” Much like in 2008, managed futures funds are again leading the way. Perhaps the term “hedge fund” needs to be redefined.

Please reach out if you are looking to add a hedge fund with the potential to hedge.