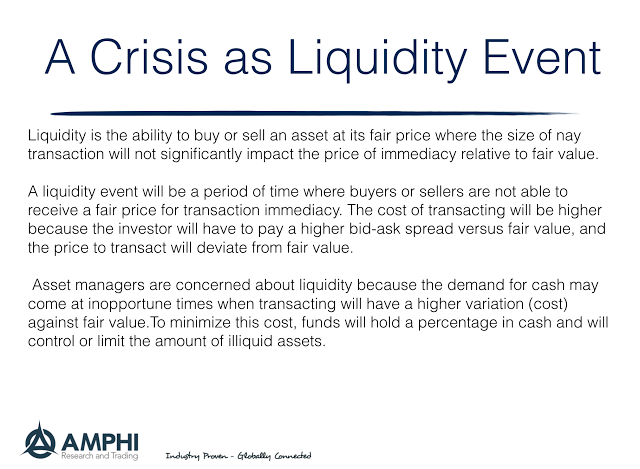

Liquidity is never present when you need it. This truism is especially the case when there is a financial crisis. A crisis become a liquidity event if sellers cannot find buyers at a fair price or at extreme any price. If the security is more specialized or complex, it will be even harder for the seller to find buyers. There will have to be a greater price decline from fair value before a buyer is found.

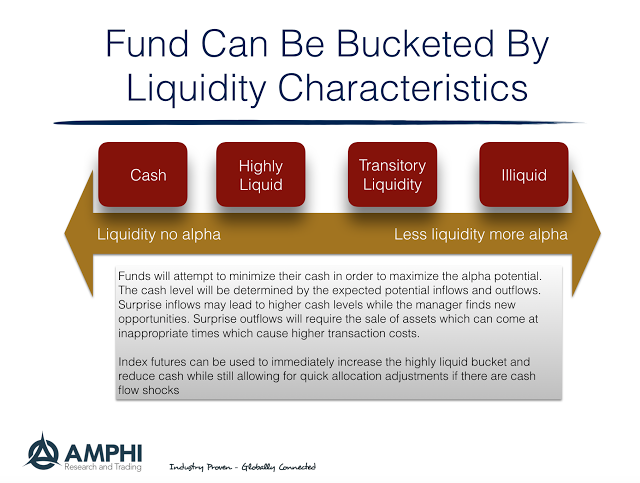

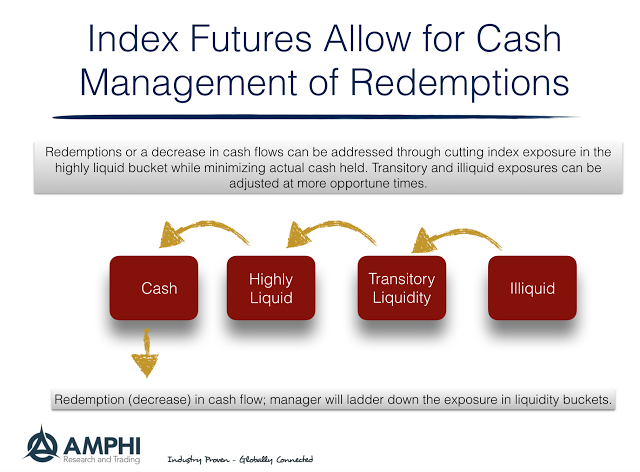

For a fund, if there is a crisis event where there is a demand for cash and significant redemptions, the fund manager will have to sell perhaps illiquid securities to generate cash in a hurry. There will be a discount for these illiquid securities that the remaining holders in the fund will have to face. A manager can avoid selling the illiquid securities but this changes the composition of the portfolio that again will harm the remaining shareholder. The more liquid assets are sold first and the remaining shareholders are left with a more illiquid portfolio. A portfolio can be thought of as a set of liquidity buckets or a liquidity ladder. If the liquid assets are only sold, there will be an imbalance for the remainder of the portfolio. To stop the potential of a liquidity run, a manager may create a gate on redemption.

Certainly regulators are more aware of these problems given the focus on bucketing the liquidity of funds and requiring restrictions on the amount of illiquid assets. Nevertheless, funds have to find a strategy that works best at maintaining liquidity.

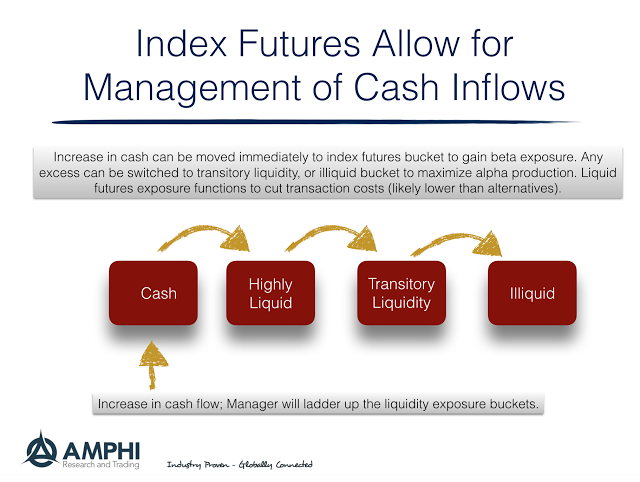

Given a simple framework there are specific actions that can be taken to mitigate some of the risks of a liquidity event. The portfolio can be bucketed into liquidity categories and liquid asset such as index futures can be used to adjust the portfolio risks for short-term shocks. A surprise inflow can be immediately invested in futures to generate beta exposure. If there is a shock outflow, index futures can be used as means of holding liquid assets that can be sold quickly.

Index futures may not solve a crisis event, but it can be used as liquid stop-gap for short-term liquidity needs.