Disclaimer:

While an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and in fact result in further losses in a portfolio. In addition, studies conducted of managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than those of the index.

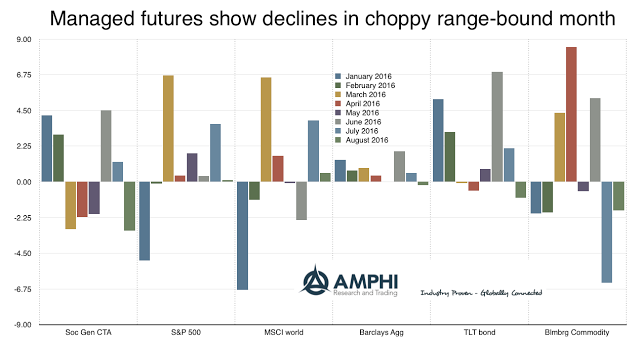

A rule of thumb for managed futures performance is that if there is little movement in the underlying asset classes, there will be negative performance for the average managed futures manager. While it does not apply to all managers, certainly trend-followers need trends, and a measure of trend is the longer-term volatility or spread in prices.

If there is no spread over the month, there is not enough information to find signals and profit from trades. Of course, I can say this as a truism, but it is not easy to predict the price range, so one cannot generally determine at the beginning of the month whether there will be good opportunities or not. Nevertheless, the current low volatility environment has placed downward pressure on manager performance.

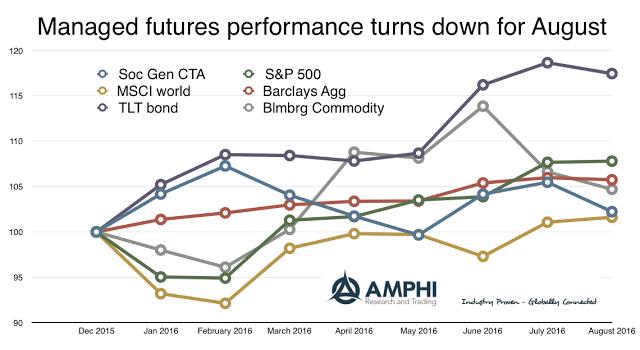

With bonds and equities following range-bound behavior, managed futures, in general, posted a negative month as measured by the SocGen CTA index. Managed futures is still positive for the year with most asset classes clustered between 2 and 8 percent except for the long bond. The high bond performance has been an outlier based on some out-sized return months associated with central bank behavior. This behavior can continue given the long duration of bonds in a low interest rate environment, but the low current yields are providing no cushion for investors.

While general returns may be clustered, a look at individual managers will find 2016 as a great year for many managers who have generated double-digit returns. The averages of an index will hide the good managers. A quick survey from last month using CTA Intelligence data of the top 40 largest managers showed 18 or just under 50 percent with double digit returns. The upside opportunity for double-digit performance from medium and small managers seems to exist in the same proportions albeit with wider spread.