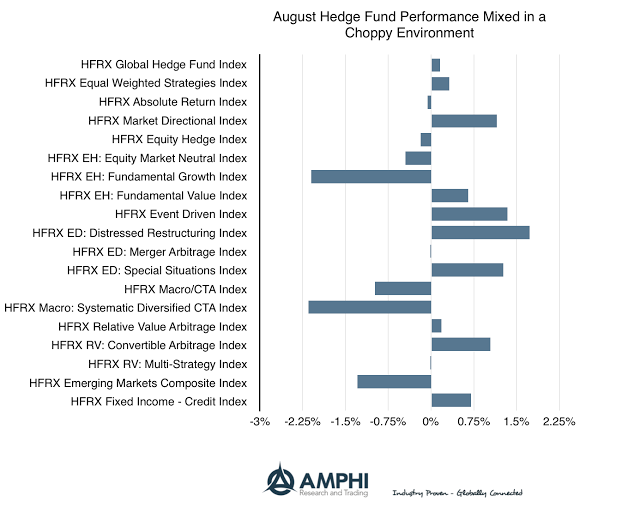

2016 is a year is turning out to be special for relative value hedge funds focused on distressed and event driven strategies. These two along with special situations, equity market direction, and convertible arbitrage moved to be the August winner. The losers for the month were fundamental growth and systematic CTA’s. Both these strategies need movement in economic or firm-specific fundamentals which just did not occur for the month. Relative to the flat equity and fixed income markets, August performance for hedge funds was at best fair.

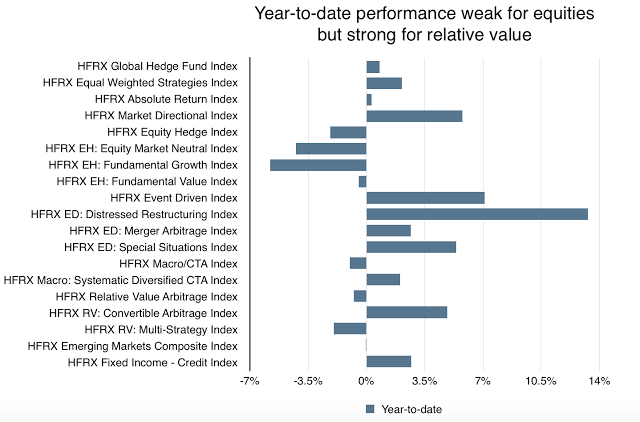

The year to date hedge fund performance is consistent with what occurred in August. Relative value strategies performed best while equity hedge fund strategies lagged. In general, alpha selection within the equity asset class has not been a big winner relative to just buying indices. The same can be said for fixed income. With a third of the year to go, hedge funds have a lot of ground to make up relative to benchmark indices.