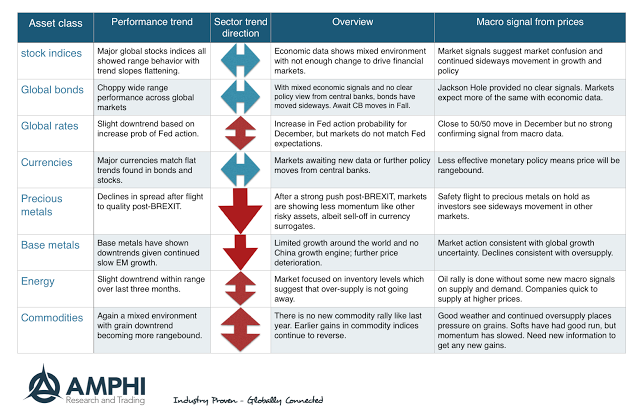

The reason for the lackluster performance of managed futures is clear from a review of trends for the major sectors. For stock indices, global bonds, and currencies, the big three asset classes, there were no clear trends for the month. Global rates, energy, and commodities also showed sideways movement albeit with a slight downward tilt. The only sectors that showed any real direction were precious and base metals that moved lower.

We use the price signals in major market sectors to tell us what market participants believe is going on in the macro-economy. The answer is simple, not much. All the major sectors are telling us there is no clear direction with economic growth, inflation, or risk-taking. The sideways movement tells us that there is no information that is dislodging prices from their current ranges. While this is not surprising during the dog days of summer, it is unlikely to last given the US presidential election, further key meetings by central banks, and further data which will tell us whether the current growth stagnation will continue. Other than the BREXIT turmoil, many markets have been range-bound for close to three months. While this is consistent with the information announcements and policy choices, it is unusual to have long periods of no trends.