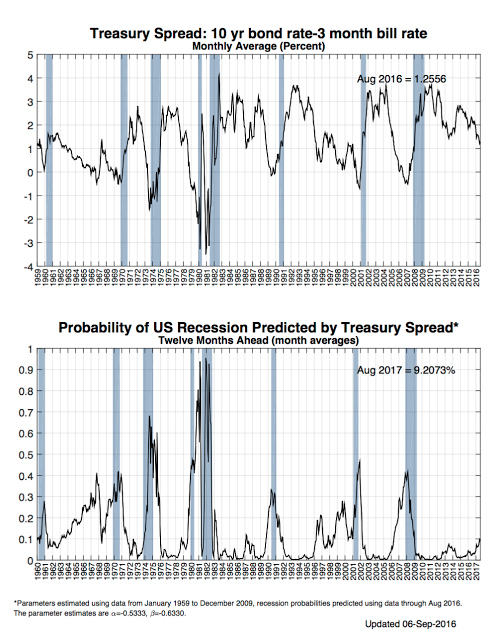

The US recession probability model based on the Treasury spread is a simple straightforward forecasting tool that can be followed in real time. If the spread term negative, watch out, economic winter is coming. Nevertheless, there are only a limited number of recessions and a limited number of signals. What is as useful is watching how the probability of a recession changes during non-recession periods. Periods of growing economic stress will see an increase in recession probability. For example, periods when the probability is more than 10% or even more than 5% will be times when equity markets will be under stress. These periods may pass without a recession, but there will be an impact on financial markets. This signal may have to be confirmed with other data since it provides early warnings, but it is valuable as a simple indicator.

The current reading at close to 10% is clearly showing that the economy may be seeing more stress. Granted, short-rates are manipulated by the Fed, but this warning could suggest a need for allocations to divergence strategies.