There are good times to invest in global macro and managed futures on a tactical level and there are other periods when the investment decision should be made on a strategic level. There are conditions when divergent strategies which are highly uncorrelated to core risky assets such as equities will do better. Unfortunately, there is not a lot of data for those periods of very strong managed futures performance. For example, crises like recessions are good periods. We also believe that periods of large deviations from fair value for an assets class will be global macro and managed futures friendly.

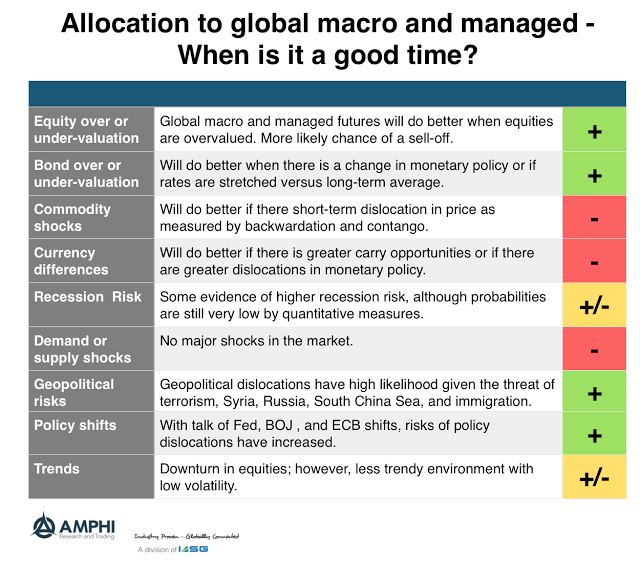

We have provided a table which may give some indication on whether the current period is good for making an allocation to these strategy. This table on the allocation environment is unrelated to the merits of any manager and is not associated with the decision to hold a long-term strategic allocation. Rather, the focus of our indicator table is to tell when a global macro managed futures manager, who can add positive convexity, is better positioned to add value for portfolios relative to other asset classes or hedge funds.

We are firm believers in the core concepts behind consumption betas. Equity investments have a higher beta because there are high risks on the ability of equities to generate returns during periods of recession which will impact the ability of investors to maintain their consumption levels. There is a higher beta to offset the risks during “bad times’. Similarly, the consumption beta of managed futures or global macro will be lower because they should do better in bad times. Higher returns are not needed because they are uncorrelated with risky assets in bad times.

This lack of correlation during bad times is the core reason for holding these alternative strategies. Consequently, if the probability of “bad times” goes up, there is more reason to hold these alternatives. Similarly, if the tail risk of certain asset classes increases, there will be greater upside potential for global macro and managed futures.

Our table is for discussion purposes and reviews the financial environment on a number of criteria to measure whether it is currently friendly to tactical global macro and managed futures allocations.

One set of criteria is the valuation of asset classes. If asset classes are over-valued, there are better opportunities for alternative strategies. This can also be applied to under-valued situations, but given the ability to go short, global macro should do better when there is large dislocations from fair value. We believe that equities are slightly overvalued and bonds may be significantly overvalued given the negative rate environment. Commodities and currencies do not have significant misvaluations that will lead to large market moves. This valuation can change with policies, but currently the greatest focus should be on bonds and equities.

Recession risks have increased but are still modest by any probabilistic measure. Currently, there are limited demand or supply shocks working through the markets. Geopolitical risks are heightened in a number of areas. Policy shift risks are also heightened albeit reactions to central bank actions have been more muted than earlier in the current business cycle. Trends are muted and market volatility is low, so there the environment is mixed for tactical allocations for long volatility except for those who want very early entry to divergence strategies. That said, global macro and managed futures will do well when there are extended market surprises.

For investors looking for a strong relative value surge in global macro and managed futures, the tactical environment is mixed and investor allocations to a strong overweight may be early. Nevertheless, strategic allocation to these strategies is still appropriate given their low correlation with traditional assets and with other hedge fund strategies.