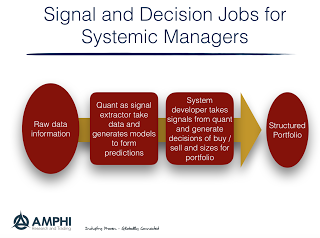

Thinking about the analysis of systematic global macro and managed futures managers, I asked a simple question, is there a difference between a quant and system developer. A portfolio system is a complete integrated approach for making market predictions and investment decisions including sizing, entry, exit, and risk management. Is it possible for a manager to be less well-trained as many newly minted engineering quants, but still be talented at building portfolio systems?

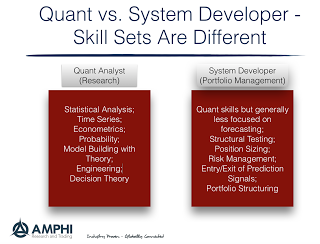

Many use these words quant and system developer interchangeably, but in practice, there are significant differences. Simply put, all quants are not system developers and all system developers are not quants. This distinction is important. A quant can find relationships in the data. The systems developer exploits the relationships found by a quant. Of course, someone could have the characteristics of both, but we view them as separate skills.

The investment into a systematic manager should focus not just on the quality of their quants, but also on the firm’s ability to build systems. This is similar to the question of differences between research and portfolio management in traditional money management. Now, this can blend into the same thing, but we believe focusing on the different skills is helpful. The quant is a signal extractor. The systems developer is a signal adaptor.

The extraction of signals can be relatively simple through looking at trends or momentum or it can be complex through the measurement of multiple risk premia. The real work may come through analysis of the system developer who has to take the signals form the models and balance them in a portfolio.

We know that predictions in financial markets have low explanatory power, so sizing position, setting entry points, and determining when to exit through either changes in signals or stop levels is critical. The set of signals across all asset classes have to be blended into a portfolio. Some will call this the art of portfolio management but it not something that is usually discussed in quant training.

The quant is perhaps more akin to the research in a traditional money management firm while the system developer is closer to the activities of the portfolio manager. By separating the functions of quant and system developer or research and portfolio management, the activities conducted by the systematic manager are given more clarity.