Momentum strategies work with commodity futures, but a closer examination shows that the same momentum strategies are ineffective with commodity spot prices. This result, that the cash price action is not mirrored in the futures prices, seems odd. Of course, the futures are expectational markets, but the cross-sectional behavior in the spot should be represented to a similar degree in futures. Alternatively, spot commodity prices show strong mean-reverting effects, while commodity futures do show this same behavior. These are the conclusions of research in the new paper, Momentum, and Mean-reversion in Commodity Spot and Futures Markets, by Chaves and Viswanathan. This research suggests that the momentum effect must be embedded in how the futures markets move relative to cash.

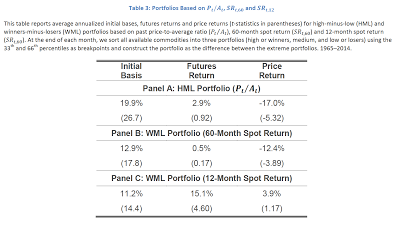

Several researchers have found momentum effects in commodity markets, so it would seem like a natural question to determine whether it is driven by behavior in the spot prices. The researchers find it is not, but they do find that spot prices are mean-reverting, which does seem consistent with the adage, “The solution to low prices is low prices.”

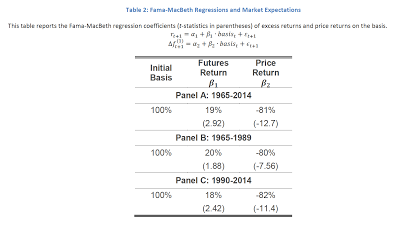

The only difference between the cash and futures prices is with the basis, which measures the link between the cash and futures, so this seems to be the natural place to look for why these differences between spot and futures exist. The researchers replicate earlier work by Fama-French to show that there is a risk premium in futures which could be an explanation for these results.

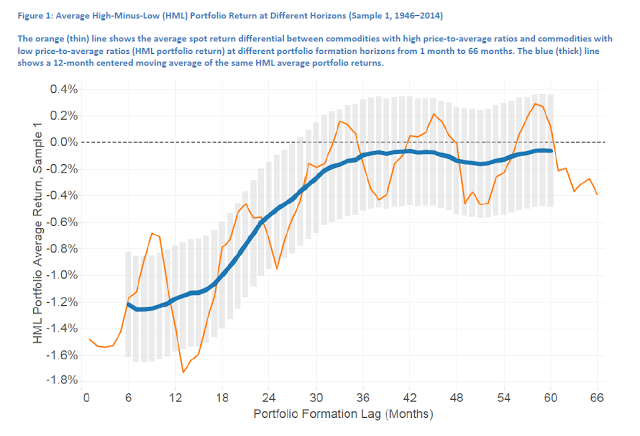

Using cross-sectional analysis, the researchers find that mean-reverting strategies do not work in futures because the futures seem to reflect the reversal in price. However, there are opportunities for momentum in futures prices when there is a significant positive basis.

The authors explain these interesting results, but I regard their work as preliminary. If anything, their work suggests a puzzle in the price dynamics of futures over spot. I believe that futures reflect storage and convenience yield in ways that are clearly not reflected in spot prices, but this will require more analysis to find the underlying relationships.