DISCLAIMER:

While an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and in fact result in further losses in a portfolio. In addition, studies conducted of managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods. Managed futures indices such as the Barclay CTA Index do not represent the entire universe of all CTAs. Individuals cannot invest in the index itself. Actual rates of return may be significantly different and more volatile than those of the index.

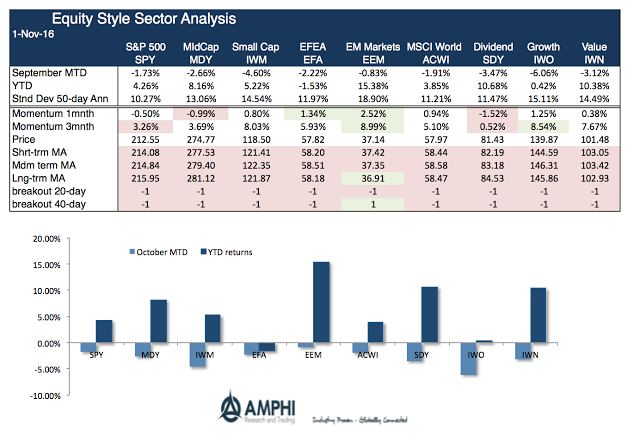

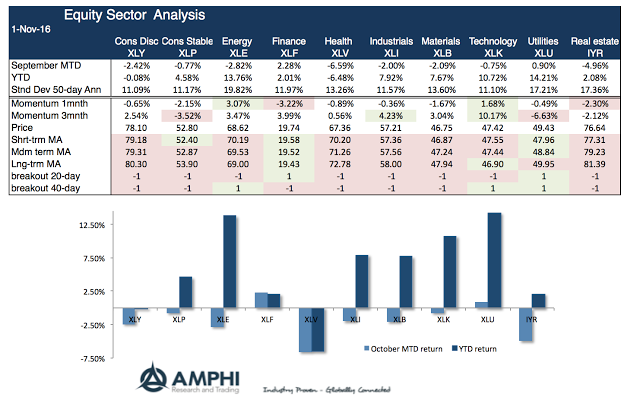

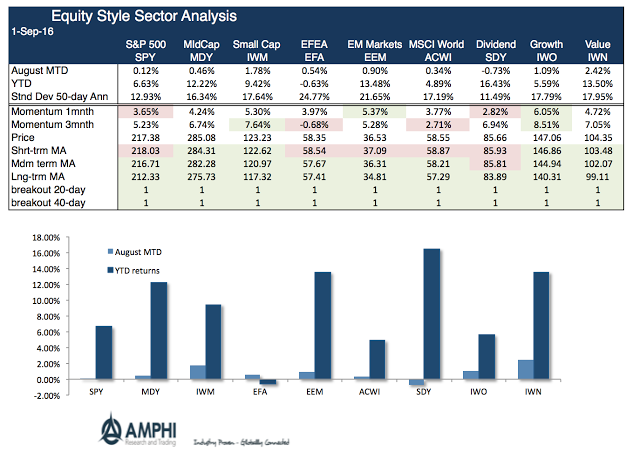

October was a painful month for investors with no place to hide in many sectors, styles, countries, or bonds. Major equity styles declined significantly especially in small caps. The only market sectors to provide investor gains were finance and utilities. The amount of dispersion across countries was surprising. Some selected country funds actually gained for October. Bonds did not prove to be a safer haven. The long bond sector was down 4% and non-dollar bonds were hurt by the gains in the dollar. Credit moved in tandem with equity markets.

Across the board equity styles showed negative returns for October with the biggest loses in small cap growth. The best performing asset class was emerging markets. Some investors viewed EM as a safe uncorrelated haven for cash.

Finance and utilities generated positive returns, but major sell-offs occurred in health care and real estate. Health care has been buffeted by the uncertainty concerning the US presidential election while real estate fell the same magnitude as the long Treasury bond.

Country specific returns showed the most dispersion with some countries like Mexico and Brazil generating positive gains. Mexico has moved with changes in handicapping of the US election. Brazil returns have been country specific given their own turmoil with politics and policy. Larger losers were those countries that are more trade dependent both in Europe and Asia.

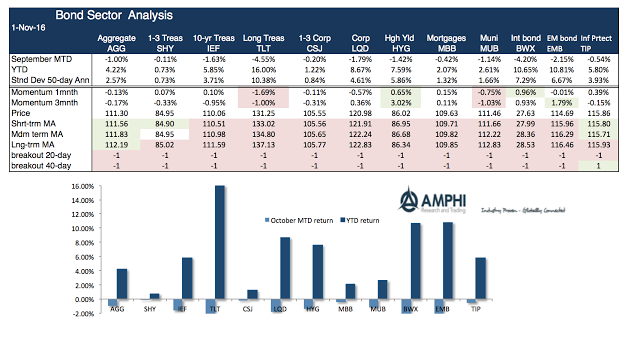

Bonds and credit sectors did not produce a safe haven for investors except for short duration exposures. Credit sectors matched the decline in equities. The long bonds did poorly and non-dollar bonds were hurt by the upswing in the dollar. Some protection for inflation fears was gained from TIPS albeit this sector still declined.