There is a strong demand for liquidity in all investments even hedge funds. However, there is a difference in the liquidity across hedge fund styles. The key investment question is whether you get paid to hold less liquidity. Is there an illiquidity premium?

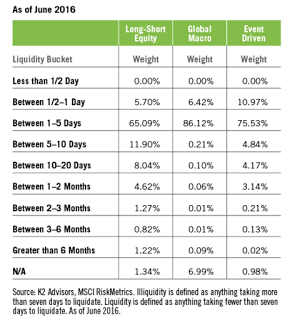

Those styles that are driven by relative value and arbitrage are likely to be less liquid than those styles focused on momentum. Those illiquid hedge fund styles should have a premium versus styles that can be liquidated immediately. Hedge fund style choices lead to liquidity choices. For example, arbitrage/relative value may need time to generate value. Hence, as the chart below shows, the long/short equity hedge fund style will be less liquid than global macro. The question is how can this difference in liquidity be measured in terms of return, and whether it is meaningful.

There is an argument is that by being less liquid and patient with money investors can receive a benefit, the illiquidity premium. Certainly this argument should be stronger for private equity. Some endowment models are based on the idea that patience and thus illiquidity will be rewarded. The question is whether this applies to all investments and what is the level of illiquidity that has a meaningful premium.

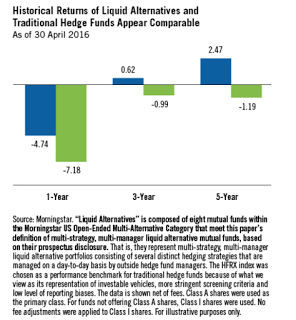

A research piece by Franklin Templeton Institutional “Liquid Alternatives and the ‘Illiquidity’ Premium: Perception versus Reality: A look at the res versus perceived benefits of liquid alternative strategies” looks at the liquidity issue from one perspective. Their assessment is that liquid alternatives are not disadvantaged versus traditional hedge funds. In fact, they argue that liquid alternatives actually perform better. This result says that there is no premium from holding less liquid investments as measure not by the underlying investments but by the terms set by the investment manager.

A question is whether the comparison used in the study is valid. This is interesting food for thought, but we can make the generalization that liquidity terms should not matter for liquid strategies like managed futures. For those strategies that find value through long-term holding, there may be an illiquidity premium. That said, investors should be careful with matching liquidity terms with the underlying style. There is no reason for a liquid strategy to have a lock-up or have long notice periods or less liquidity.

Nevertheless, it is not clear that daily liquidity is necessary for all investors. Cash flows should be anticipated, and quick decisions to liquidate may be harmful.