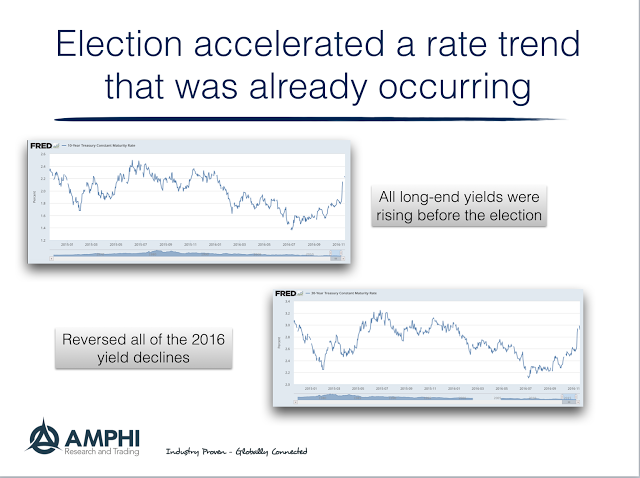

Yields exploded on the upside after the election and has seen one of the largest routs in recent years, yet it would be wrong to believe that this is all associated with the election. A close look at the trend sin yields show that the market broke above moving averages at the end of September. Using simple moving averages (20, 40, and 80-day), we would have called a change in bond sentiment weeks ago.

All of the bond returns from the rally earlier in the year have reversed. 2016 has become a tale of two markets. First, there was a market driven by fears of low inflation and slower growth with a Fed cautious about the economic environment. Second, there is a more confident Fed that believes now is the time to act based on low unemployment and inflation approaching or exceeding 2%, depending on the measure used.

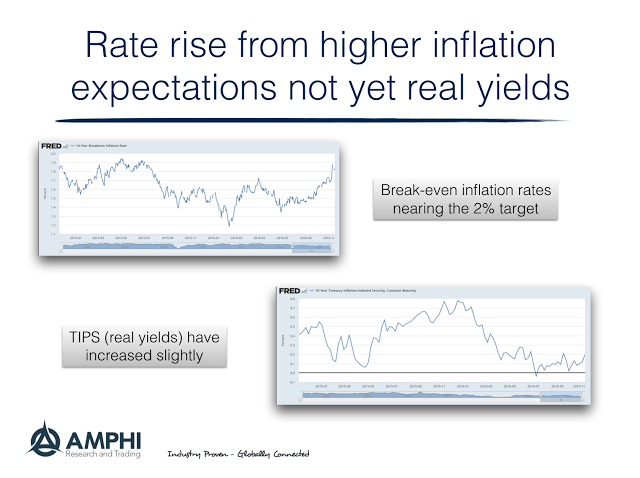

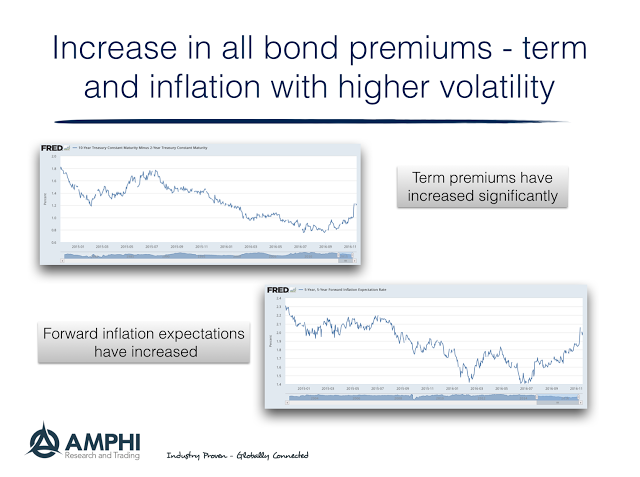

Call it a normalization of bond risk premiums based on new thinking of inflation. With long rates rising above short rates, term premiums are increasing. Longer-term inflation expectations are rising albeit to long-term policy expectations. Break-even rates are rising above last year, but TIP’s rates are increasing only slightly. This suggests that real rates may not be focused yet on a change in economic growth trend. We are moving to an environment that could be the new bond normal with risk premiums and inflation expectations back.