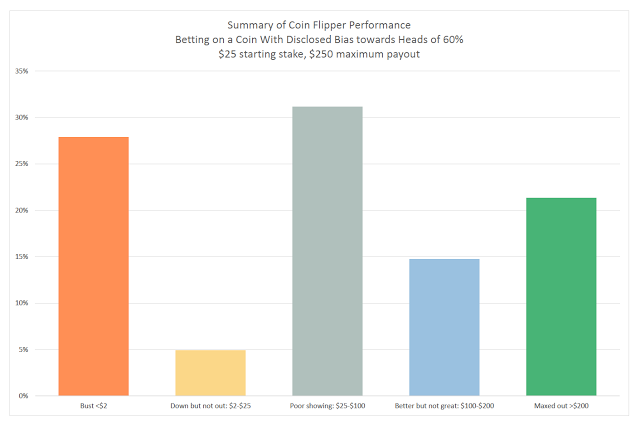

You should expect that if a group of college-aged students in economics and finance and young financial professionals were given a fixed amount of money and told they could flip and bet on a biased coin with a 60% likelihood of heads, they should be able to make money. Don’t bet on it. “Rational decision-making under uncertainty: Observed betting patterns on a biased coin” by Victor Haghani and Richard Dewey is a simple study that makes you question the decision-making skills of even financial professionals. Just under 30% of the players in this game went bust, and another 5% lost money. Under 25% got it right using an optimal betting strategy that maxed wealth.

The game was simple, with the subjects given $25 and told they could bet and flip for 30 minutes in a controlled environment to maximize their wealth. Given the framework, the optimal betting rule to maximize wealth would be the Kelly criterion, a fixed portion of wealth used for each bet (2*p-1), where p is the probability of success. Even assuming that the subjects did not know the Kelly criterion, a limited proportional scheme might make sense. Well, the researchers found subjects who bet it all, used fixed betting sizes, followed a process of doubling down, and reversed the bet on heads based on the expectation of a reversal. You name it, and some educated ‘traders” tried something that was not optimal.

The researchers noted that none of the top business schools and most sub-subjects have been told about betting strategy. That type of decision-making is not taught in finance.

The results make you think. On the one hand, it makes you almost want to cry, knowing that so few may know how to size bets. Alternatively, you want to clap for joy for those who know how to play the game. For those traders, there is opportunity. You have to say hats off for to all of the systematic traders who have embraced optimal betting strategies to ensure survival and maximize wealth.