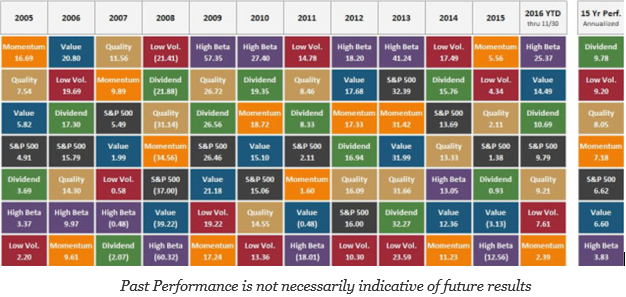

From ETF Trends comes an interesting chart on the relative performance of different risk factors for US large cap equities. Factor analysis and building portfolios based on specific factor risks has become all the rage in investing. We think this is useful and significant advancement to portfolio management, but there is still a lot to learn about the dynamic behavior of factors.

All factors move through up and down periods across the years. The hot “low vol” factor has been one of the top two performers four times out of the last 12 years, but it has also been in the bottom two performing factors half the time or six times out of twelve. Strong performance follows poor performance for this factor. If you load on the low vol factor, you may be in for a wild performance ride. Nevertheless, the long-term differences in performance are more muted.

Simply put, no one factor will perform well all of the time although some combinations may have lower downside risk. Clearly, the SPY index will be in the middle of performance for the simple reason that it weighs all of the factors together. If you don’t know how to manage the factors, just hold the basket. It could be argued that the dynamic performance of some factors keep investors from demanding some factors because they do not want to suffer the regret of underperforming.

What does this mean for investors? There has to be more work on this issue, but holding static risk factors may not be appropriate. A dynamic factor allocation approach may actually do better than a buy and hold approach. Now, everyone should be suspect to any active allocation approach. Most dynamic strategies do not work, but the swings in performance suggest that careful research should be done in order to explicitly answer the question.