There is the foundational view that increased uncertainty will and should lead to changes in our economic behavior. There should be an increased desire for caution. Investments in the future should be smaller or deferred. There should be an increase in the holding of cash versus any risky investment. Actions may be scaled or averaged to reduce potential regret. Risk aversion will impact the return needed to offset the risks faced. Uncertainty should be avoided or at least approached with caution.

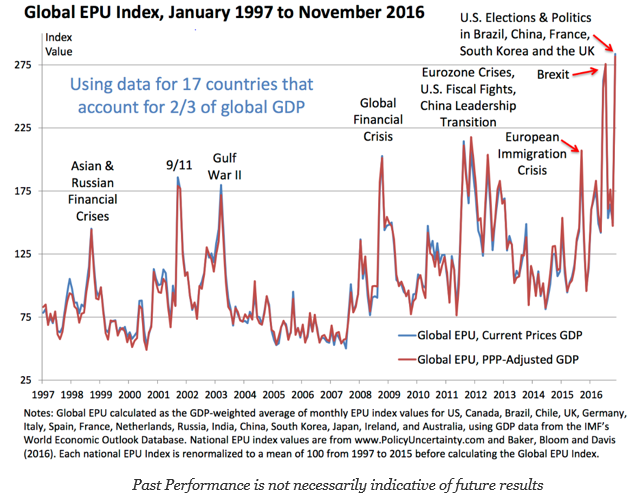

Now, if we look at the new global economic policy uncertainty index from a group of leading academic researchers, we will see it is at all time highs since its inception in 1997. The index is a combination of data used for their popular country indices

This may be the most important chart for 2017. Forget the economic predictions that are being given for the new year and embrace the uncertainty that we are facing now. This means that maximum diversification is the best form of asset allocation protection. Whatever has been a winner in 2016 should not be assumed to carry-over to 2017. What should be the winner is holding more uncorrelated assets. Embrace uncertainty through diversification.

For more active investing, this means holding divergent strategies and those that have higher convexity. If you cannot predict the direction of the markets, then hold assets and strategies that can make money from extremes or strategies that can be nimble enough to switch directions in the face of change. Hold credit strategies that look for widening opportunities. Look for value under the assumption there is downside protection. Look to global macro and managed futures as divergent hedge fund strategies. Again, this is a time to embrace the high uncertainty through specific choices but not specific predictions.