Don’t try and call the direction of the markets with some forecast which will most likely not come true. Decide the environment that we live in and determine what will be the best portfolio to take advantage of it, or as I say often, “You cannot tell where you are going until you know where you are.” A key for knowing your economic location is through determining whether there is financial stress in the economy. Stress leads to change. When stress increases or falls, investors will become more risk averse or risk seeking. It is a driver of volatility.

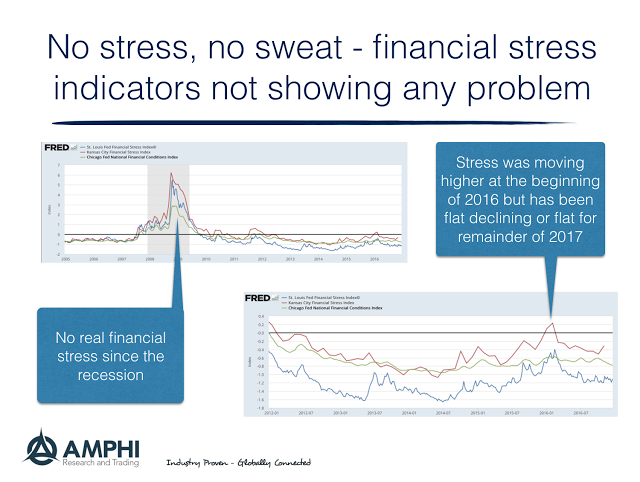

We look at the financial stress indicators from some of the Fed banks (Chicago, St Louis, and Kansas City) as a first pass on financial stress. If these are moving higher, investors will move to a risk-off portfolio. If stress is falling, investors will move to risk-on. We have not suffered from any serious bouts of stress since the Great Financial Crisis, but there have been periods when it has became elevated like the beginning of last year. This was the period of the large equity sell-off. Similarly, we had elevated stress in 2012 which was offset by QE3. Right now, stress is flat and below average. A risk-on mentality should continue with investors.

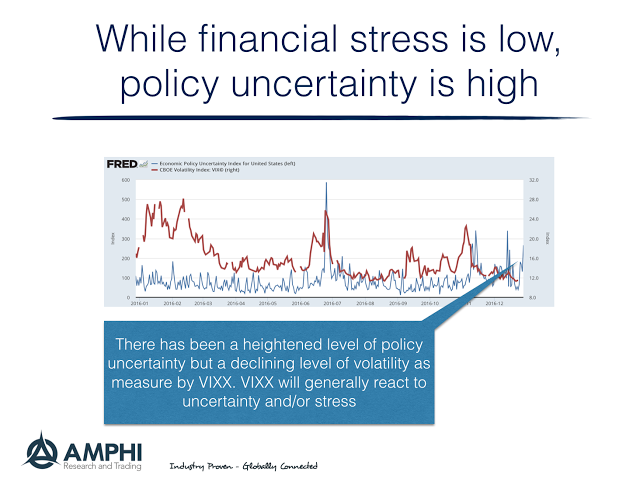

Nevertheless, we do see a problem with uncertainty the cousin of stress which has moved to elevated levels. Our concern is that this uncertainty has not translated to higher volatility in markets. While the VIX volatility index may move higher without uncertainty, most strong increases in uncertainty is coupled with higher volatility. Consumer and business confidence have moved higher, but this mood may be fragile in an uncertain world.

Follow stress and uncertainty to help determine the current state of the economy. These will be priced into markets no different than economic growth. Perhaps these numbers are subtle, but they set a baseline on whether we are in a risk-on or risk-off environment.