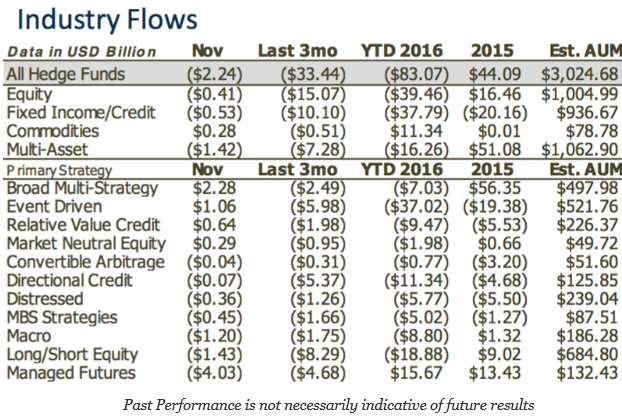

The latest hedge fund asset flow report published by EVESTMENT tells a tale of an industry that has become more competitive and is in a period of consolidation. The easy money of being a hedge fund manager is over. Now, you have to earn your AUM through offering a better product. The year to date outflows for 2016 have been $83 billion which is small on a $3 trillion base, but suggests that investors are getting more particular in what they expect from hedge funds. Couple these outflows with the higher level of fund closing and we see a competitive market place which is unforgiving to managers. It does not matter whether you think you have investment skill; poor performance will relegate you to obscurity.

Investors are more willing to rotate their hedge fund exposure based on what they may expect from a style or asset class focus. For example, commodities and managed futures showed a net gain $27 billion in 2016, but these flows may reverse if performance does not come in 2017.

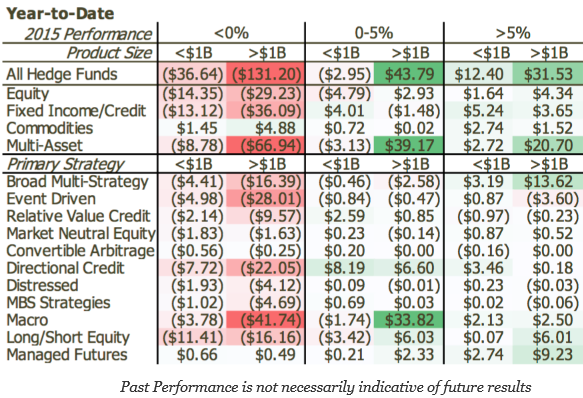

Performance matters for asset growth. If a fund had negative performance in 2015, there were investor outflows. If you have good performance, money will flow in your direction. Given the fact that hedge fund performance does not seem to show memory, investors may be chasing returns. Nonetheless, big or small, if you don’t make money for clients, investors will leave and they may not return.