The euphoria of the US presidential election is over. The market jumped under a new wave of optimism associated with an end to fiscal austerity, tax cuts, and regulatory reform, but now the reality has to set in and investors have to see the actual policies and believe they will be effective. This new sense of reality may describe the current price action for asset classes. You can call it mean reversion or a response to an earlier over-reaction.

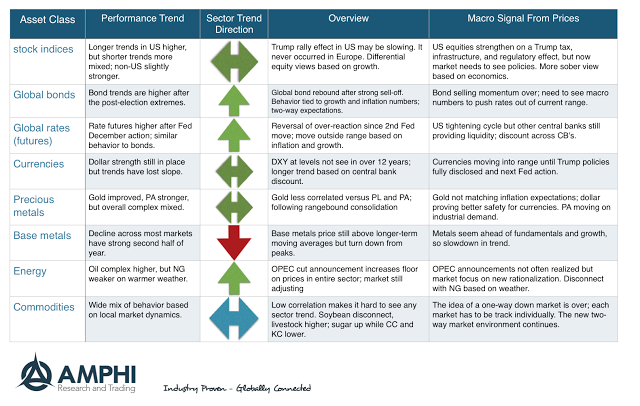

Stocks have become more range-bound. Bonds and rates have improved after a disastrous rate rise this fall. The dollar trend has lost momentum and precious metals do not show clear direction. The strong gains in base metals have reversed and commodities are showing more de-correlation.

Our general view is that this month is not a good trend-following environment give the directions shown at the end of last month. This should not be surprising. We expect that on a probability weighted basis most time is spent in trend-less markets. There may be gains in selected markets but there are no strong asset class directions that can generate strongly monthly performance.