Whoever wishes to foresee the future must consult the past; for human events ever resemble those of preceding times. This arises from the fact that they are produced by men who have been, and ever will be, animated by the same passions. The result is that the same problems always exist in every era.

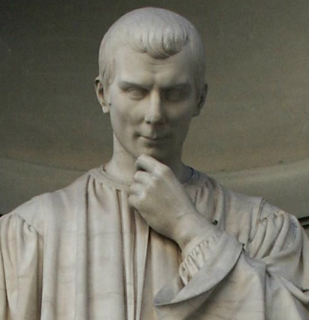

– Niccolo Machiavelli

Perhaps he could have been a trend-follower or at least he would have understood the underpinning of many trend-followers who believe in repetitive behavior as a foundation for trend generation. Machiavelli was a student of behavior and modern political science who had a clear vision of analyzing behavior for what it is as opposed to what it should be. Realism is important for any investment manager. It is not what markets should do, but what they do that matters. Many may say that a certain market should be lower, but that does not always matter. It is the weight of opinion with sentiment that matter for price direction especially in the short-run of days or weeks.

A recurring research work on valuation is the experiment of knowing whether perfect foresight on company earnings is enough to get prices right. Surprisingly, this key knowledge can only explain a fraction of price behavior. This type of research was the focus of Robert Shiller in the 80’s and the conclusions still seems to be true today. Markets move more than what is expected from fundamentals. In spite of all of our knowledge about behavioral finance and theory, there still is a difference between model expectations and reality. In spite of all our work on multiple risk premiums, momentum is a foundational factor.

There are three kinds of intelligence: one kind understands things for itself, the other appreciates what others can understand, the third understands neither for itself nor through others. This first kind is excellent, the second good, and the third kind useless.

– Niccolo Machiavelli