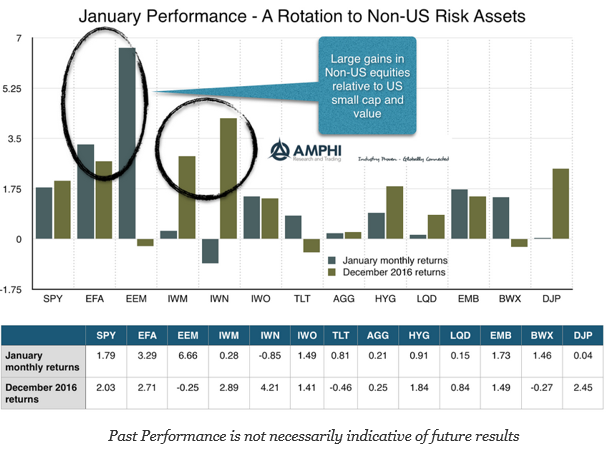

After the euphoria in small cap, value, and growth stocks post the Trump election, the markets have calmed and moved slightly upwards. Global equities and emerging markets stocks were the big winners for the month. These moves were a degree of catch-up to the outperformance in US stocks. Even with the poor print for fourth quarter GDP, equity investors are discounting better growth in 2017.

Bonds in all subclasses were positive after the major sell-off in the fourth quarter. Again non-US assets did better with developed and emerging bonds reversing some of heir fourth quarter declines. A more stable dollar, which usually indicates less economic and political turmoil, helped these markets.

There were no discernible trends in these markets which would indicate some January effect that will set the tone for future returns. Regardless of the political turmoil in the headlines, markets were focused back on the simple economic factors that matter. Will there be economic growth? Will earnings improve? Can individuals, corporations, and governments manage the leverage that is still in the economy? After a strong 2016 finish, many investors are concerned with valuations and simple technicals. The “wall of worry” is not just with politics but with the simple issues of where will future cash flow be generated. This economic focus does not discount the political upheavals this year, but as is often the case, uncertainty is hard to measure in terms of asset pricing.