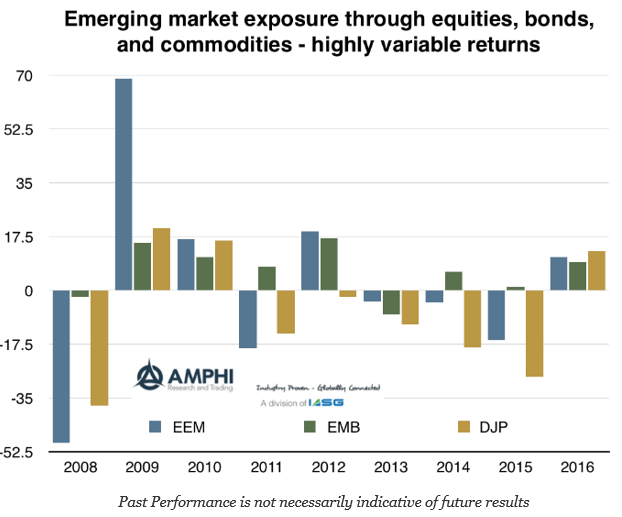

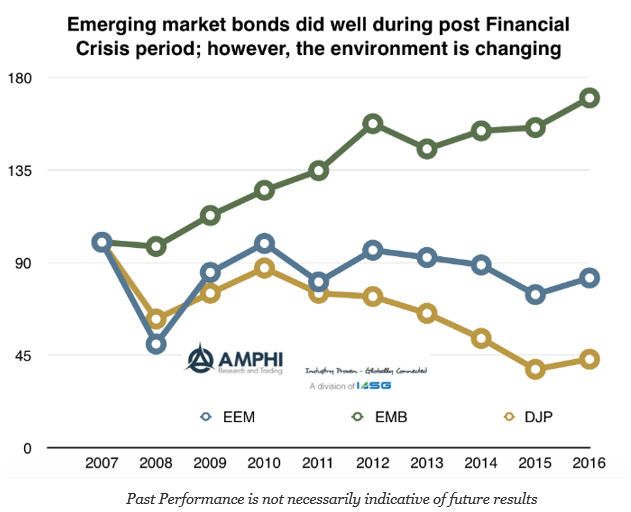

Emerging markets have been a tough place to invest especially in equities during the post Financial Crisis period. We include a stock index (EEM), and bond index (EMB) and a commodity index (DJP) for some simple comparisons of three ways to play emerging markets. After a strong rebound in 2009, emerging market equities have generated no returns for investors. Slower growth, poor commodity markets, and a stronger dollar have left equity holders with nothing to show for seven years. Emerging market bonds have told a different story with strong consistent gains since the Financial Crisis even with the strong dollar move over the last few years.

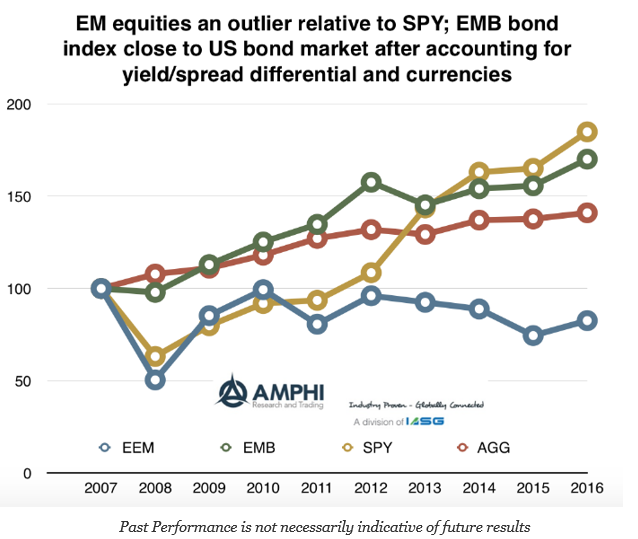

A comparison against US stocks and bonds from 2008 to the present provides a glimpse of the relative risks. While US equities have soared, there has not been the same performance in EM; however, EMB has gained more than the US AGG index. Declining growth and lower inflation with a flood of foreign capital allowed EM bonds to outperform emerging market equities.

The relative equity difference is quite large and history suggests that this gap should close, but it will only happen if the economic growth difference between regions moves back to historical norms. An EM investment requires stronger EM growth. There are some stronger economic signs and expectations as well as a surge in January returns, but US growth still need to be a trade engine for EM even though the US is a smaller portion of global GDP. At the least, we believe there will be more upside in EM equities over EM bonds given an uptick in inflation and higher growth expectations.