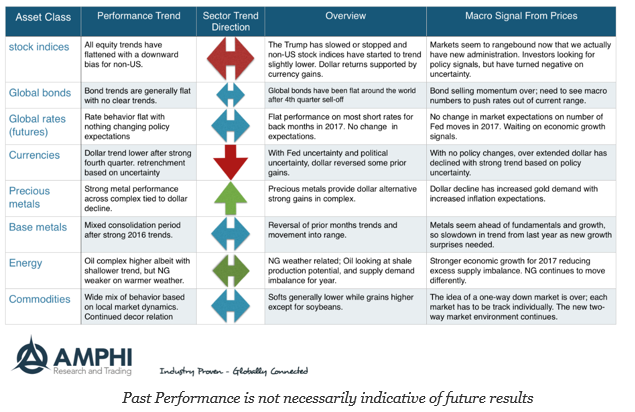

Our sector indicators have all pointed to more trendless behavior for the major asset classes. The only major trend was a decline in the dollar for January and stronger moves higher for precious metals. With higher inflation expectations, and policy uncertainty, there are fundamental reasons for these moves.

Stocks showed sideways movement albeit there may be a slight downward bias. Bonds are directionless at this time after a strong reaction to potentially higher growth and inflation during the fourth quarter. The overall market impression is that the combination of a policy uncertainty and the adjustment to the Trump administration has caused asset allocation caution.

This view is consistent with our bimodal world where investors are searching for signs of either a slowdown or new lift-off from aggressive fiscal policy. Since signs are not currently obvious, markets have fallen into a range. The caution is caused by the choice of extremes and not from uncertainty of not being sure of what will be the next direction of the macro economy. This may be a subtle distinction but with two extreme choices, the problem of regret is much larger. If you don’t want to be wrong, you will wait on making allocation changes.