Commodities were supposed to be the great portfolio diversifier, a real asset that protects against inflation, offered positive roll yield, and gains from a super cycle. The reality over the last eight years has been much different. The roll yield disappeared as markets turned in many cases from backwardation to contango. Investors were penalized with negative roll. The super cycle ended with the Great Financial Crisis with a market decline over 75%. The markets have been digesting an excess supply/demand imbalance for years. The final kicker for investors was the financialization of commodities. Correlations with equities rose so investors did not get the diversification free lunch that was expected from looking at historical data. Now times are different, so throw out the old thinking.

1. The negative roll has subsided. The great backwardation period of the ’90’s is not here, but the huge penalties when there were large oversupplies are also gone. The cost of holding commodities through an index has declined.

2. The large cyclical decline in commodities is over for many markets, not all, but many with the bottom of the super cycle seeming to have occurred last February. The market is a long way from retaking loses, but there seems to be more market balance.

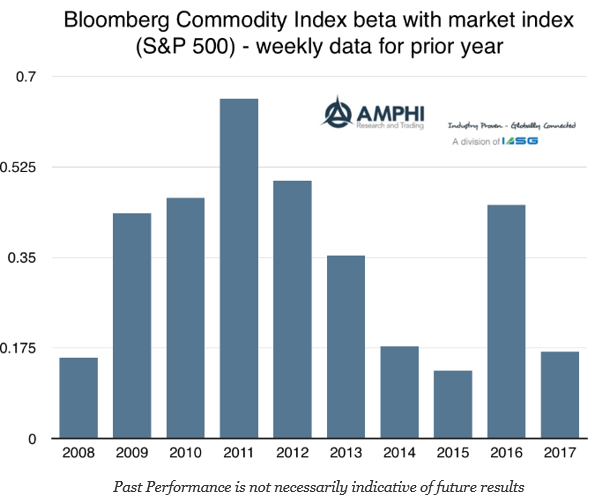

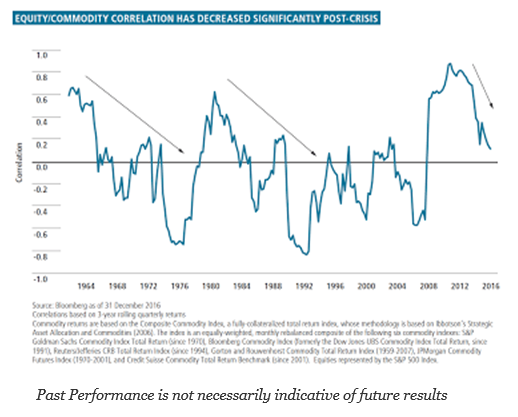

3. The correlation between equities and commodities has declined. Many of the large money managers who traded commodities as a simple adjunct to equity and bond portfolios have left and many pensions have under-allocated to commodities. The correlation between the Bloomberg commodity index and market index has fallen and the long-term rolling correlation while still positive has fallen to the lowest levels since the Financial Crisis.

Note, an asset can have a positive contribution to a portfolio’s Sharpe ratio even when the marginal return contribution of an asset is lower than the overall portfolio when the asset’s correlation is lower or negative to the target portfolio. Given the strong diversification value and the opportunity for upside if there is a rise in growth or inflation, increasing commodity allocations may be appropriate. The correlation between inflation and commodities is actually not strong, but the combination of higher inflation with expected stronger economic growth is a recipe for better commodity prices and for stronger relative performance especially against bonds.