For many investment strategies, the difference between a good and a bad manager is based on their ability to manage risk. It is as much about how volatility is handled as return generation. A good strategy that does not manage risk well will never be successful.

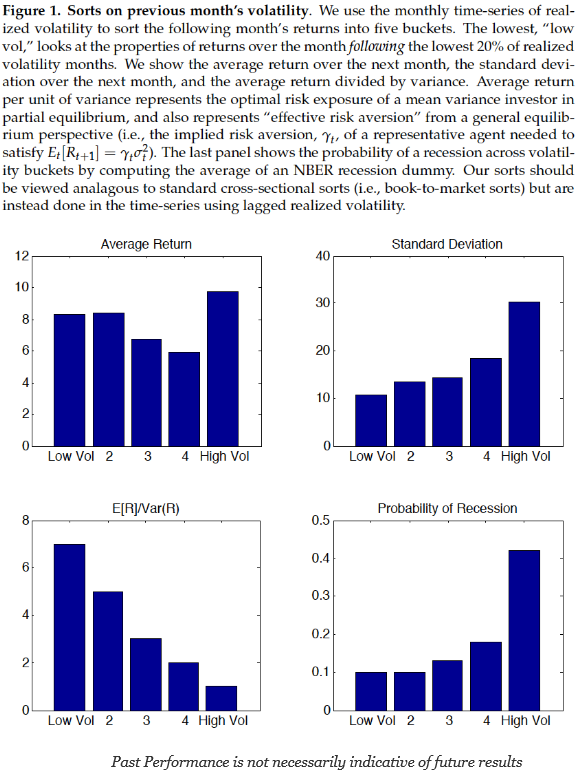

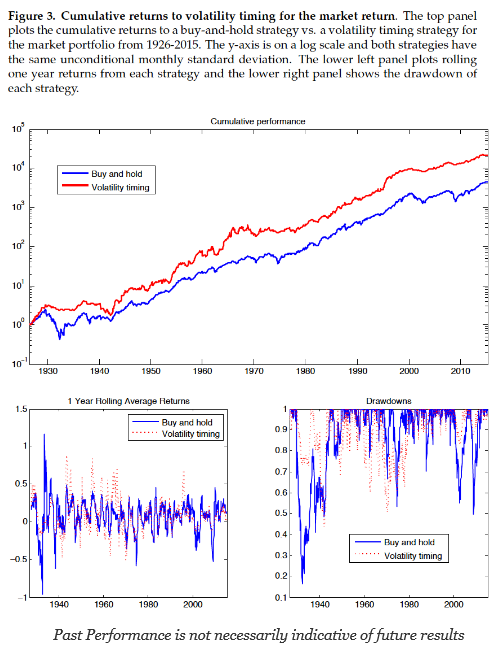

A key conclusion from a recent paper that focuses on volatility and factor management shows that controlling volatility provides a significant enhancement for many factor-based strategies. If you control volatility, you will get a positive bump in return to risk ratio.

This is at odds with the conventional wisdom of some in finance who believe you must be in the market during risky periods like a recession to gain extra return. You get paid to take risks during periods like a recession. This new research says that it does not matter when you invest in the business cycle. Managing risk will improve performance, and that means cutting exposure when volatility is high. Timing market volatility will help any investment strategy because volatility is generally independent of return. Put differently, if you control the risk, you will be better off versus a simple buy-and-hold for a given factor exposure.

This is all explained clearly in the paper “Volatility Managed Portfolios” by Alan Moreira and Tyler Muir. Their approach to volatility management is very straightforward, which makes their conclusions so powerful. The authors scale exposure by the inverse of conditional volatility while focusing on the classic Fama-French factors and carry. Since volatility is a persistent variable but not highly predictive of excess returns, managing or timing risk is not closely associated with the factors driving returns.

The importance of this paper is evident once it is read in its entirety. The authors carefully address many of the concerns readers may have and test the hypothesis from several perspectives. While the enhancement from volatility management is not strong in all cases, the weight of the evidence suggests that volatility management is a key way for managers to enhance return to risk.

The real market skill for many managers may be with their timing of volatility and not returns. Cutting (raising) exposure at higher (lower) volatility periods seems to be a proven strategy for alpha generation and Sharpe ratio increases. This research supports a comment I have often used, “I would only charge 75bps for a simple trend-following model but 125 bps and a 20% incentive fee for the risk management.”

(Hat tip to Peter Golger for pointing me to this paper.)

Photo by Weston MacKinnon on Unsplash