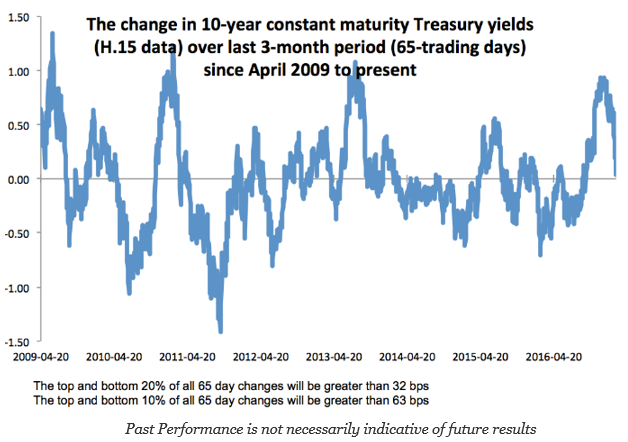

There is still concern about the potential for large moves in bonds during the next three months. The latest rolling yield changes shows a calming after the large moves late last year. Nevertheless, uncertainty on policy, growth, and the equity markets may all impact Treasury yields, the “safe” asset. If safe means limited moves in yield, investors may be in for a surprise. A flight to safety can easily take the 10-year below 2% while a pick-up in inflation or growth can lead to yields pushing closer to 3%.

Looking at the change in yields across the post crisis periods suggests that the risks are significant just based on normal bond movements. Over any 65-day trading period for the 10-year constant maturity Treasury index there is a 20% likelihood that yields will move by more than 32 bps up or down. At the current yields, we could easily see yields above or below 2.70 and 2.10 over the next three months. More importantly, there can be a move of more than 100 bps up or down over the next quarter, albeit the probability is about 1% using data over the last seven years. What is clear is that a return to sub 2% yields or a move above 3% is not crazy talk even under a low rate environment.