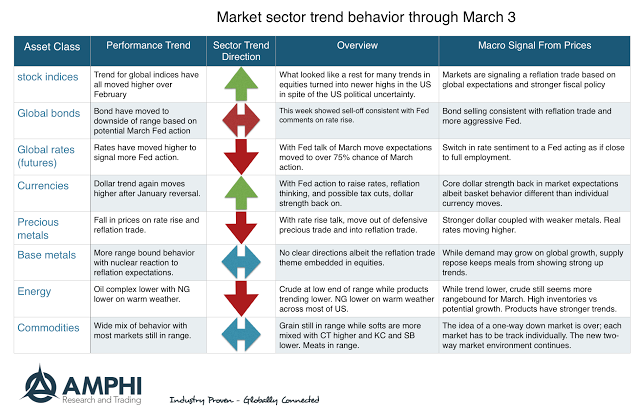

What seemed to be a slight rest at the beginning of the year has turned again to a strong equity bull market. The reflation trade is back as signaled by equity index behavior. Bonds also suggest a reflation trade given the recent talk by Fed Chairman Yellen and other officials concerning the likelihood of Fed action in March. While not a rout, bonds are also signaling a growth trade.

A tighter Fed has translated into a stronger dollar and a precious metals sell-off. However, the commodity markets are more mixed and seem driven by specific market dynamics and not an overall view towards global reflation. Equities are showing optimism that is not present in other assets.